Month: May 2016

How to market and sell to GA and BA audiences

This final installment in our series on purchasing behavior in General Aviation (GA) and Business Aviation (BA) seeks to better understand the marketing tactics that are likely to be most effective with these audiences.

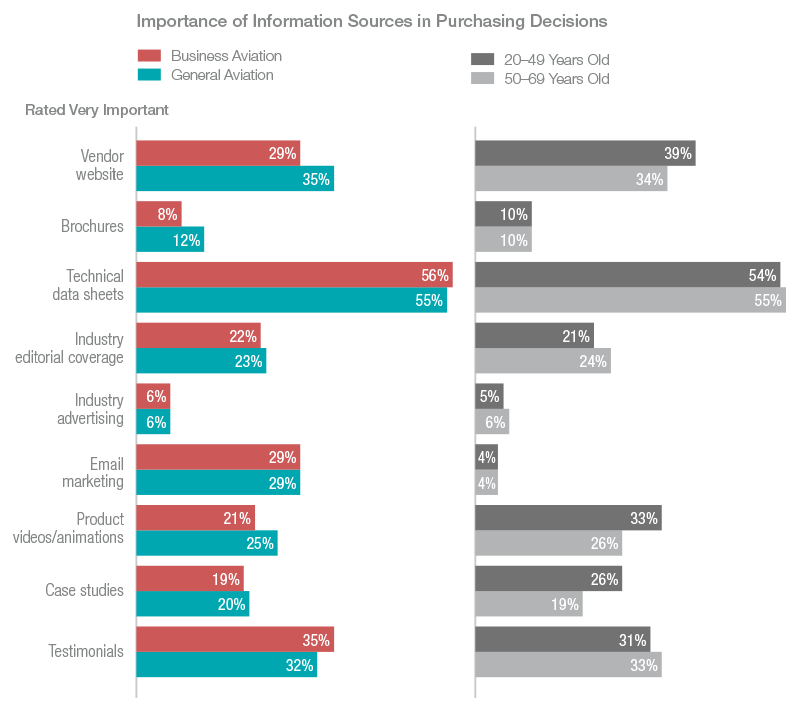

We asked respondents to rate the importance of various information sources they may reference during the decision-making process and were surprised to learn that technical data sheets are strongly favored, regardless of age or market segment. Fifty-six percent of respondents consider data sheets very important, and an additional 35% see them as moderately important — that’s 91% of respondents.

Regardless of age or market, respondents also value testimonials, vendor websites and product video/animations, but industry advertising ranks dead last with all groups surveyed.

How much of your marketing budget is devoted to advertising or brochures? If you are spending a significant amount on these items it might be time to reconsider and reallocate to other resources that buyers find more important.

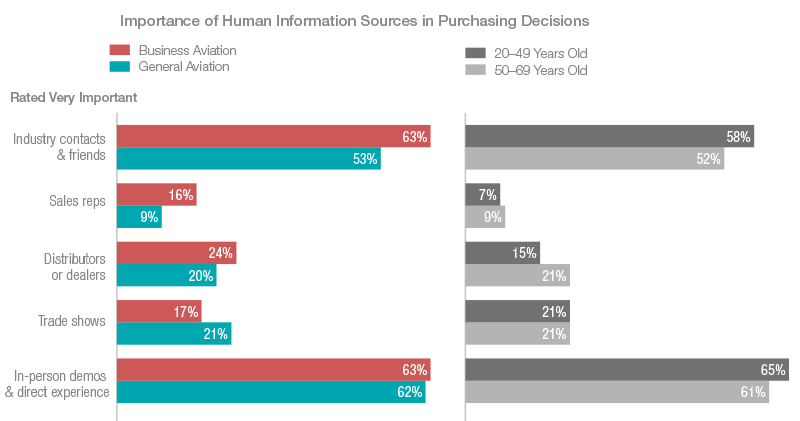

Who, among human information sources is least valued? Sales reps. Only 9% on average consider sales reps very important. In-person demos or other direct experience rates the highest, followed closely by industry contacts and friends. Distributors or dealers and trade shows fare only slightly better than sales reps. We were most surprised by the rather mediocre performance of trade shows, especially with the BA respondents, who also place greater value on their industry contacts and friends than do the GA respondents.

It turns out that no one, regardless of age or market segment, wants to be sold, either by sales reps, or dealers, or at trade shows. This tells us that an inbound marketing approach, where businesses draw customers to them by providing helpful content (and not sales pitches), could have great utility and value for aviation marketers.

We also asked respondents what resources they refer to during their consideration and evaluation process prior to making a purchase. All respondents prefer to speak with trusted colleagues over Google searches and referencing company websites. BA respondents place more value on their existing knowledge, while print and digital magazines rank last with everyone.

But when you whittle down those choices and ask respondents to pick just one resource, speaking with trusted colleagues is picked 43% of the time, followed by a big drop to 14% using Google, then about a 50% drop to the other “top” choices such as website, existing knowledge and magazines.

As we keep seeing throughout this series, people trust their own experiences and the opinions of friends and colleagues; performance is king; brands are not important; and no one wants to be sold.

For marketers, the keys to the kingdom are in finding ways to allow more people to use the product/service and then turn those users into unpaid evangelists. Work hard to make non-sales-y, factual and data-driven information available via multiple channels, including the web. And look carefully at the investment being made in trade shows, brochures and advertising. You may find it wise to re-allocate some of those funds to product demos, content marketing or referral programs.

To learn more about buying behavior in GA and BA, reference the other blogs in this series here and here. To subscribe to this blog and enjoy weekly email delivery, click here.

To approach your marketing in a more strategic fashion, download this easy-to-use marketing planner. It’s one of the most popular resources we offer.

Decision-making factors in the aviation buying process

The May 10 Flight Manual focused on understanding the characteristics of purchasing decision makers within the business aviation (BA) and general aviation (GA) markets.

This week we dig deeper still to gain insight into the product and supplier factors that most influence their buying decisions. This goes to the heart of what buyers value most, so it’s directly relevant to those who market and sell to these audiences.

Looking at responses by both age and market we learned that, with a few exceptions, buyers tend to value the same things regardless of age or segment.

This is a somewhat high-level generalization, and we will highlight points of difference, but there are clear trends and preferences that apply across the board. It’s clear that people in these markets are more similar than they are different. Let’s take a closer look.

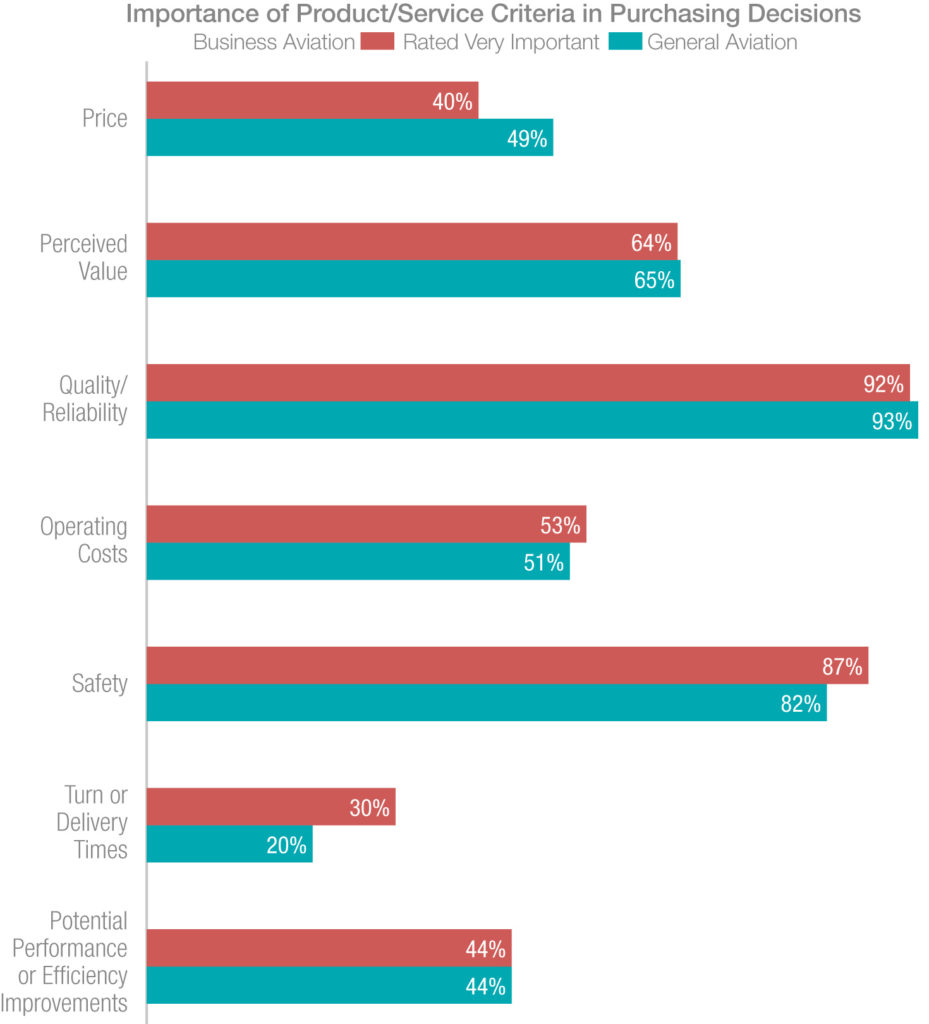

We asked respondents to rank the importance of various product and service criteria in their purchasing decision-making process. These criteria included price, perceived value, quality/reliability, operating costs, safety, turn/delivery times, and potential performance or efficiency improvements.

Both market segments are most concerned with quality and reliability, closely followed by safety, which was even more important to business aviation respondents.

While price is more important to GA, it is not the most important factor. In fact, it is similar in importance to efficiency improvements, and both are trailed by turn/delivery times, which matter more to BA than GA.

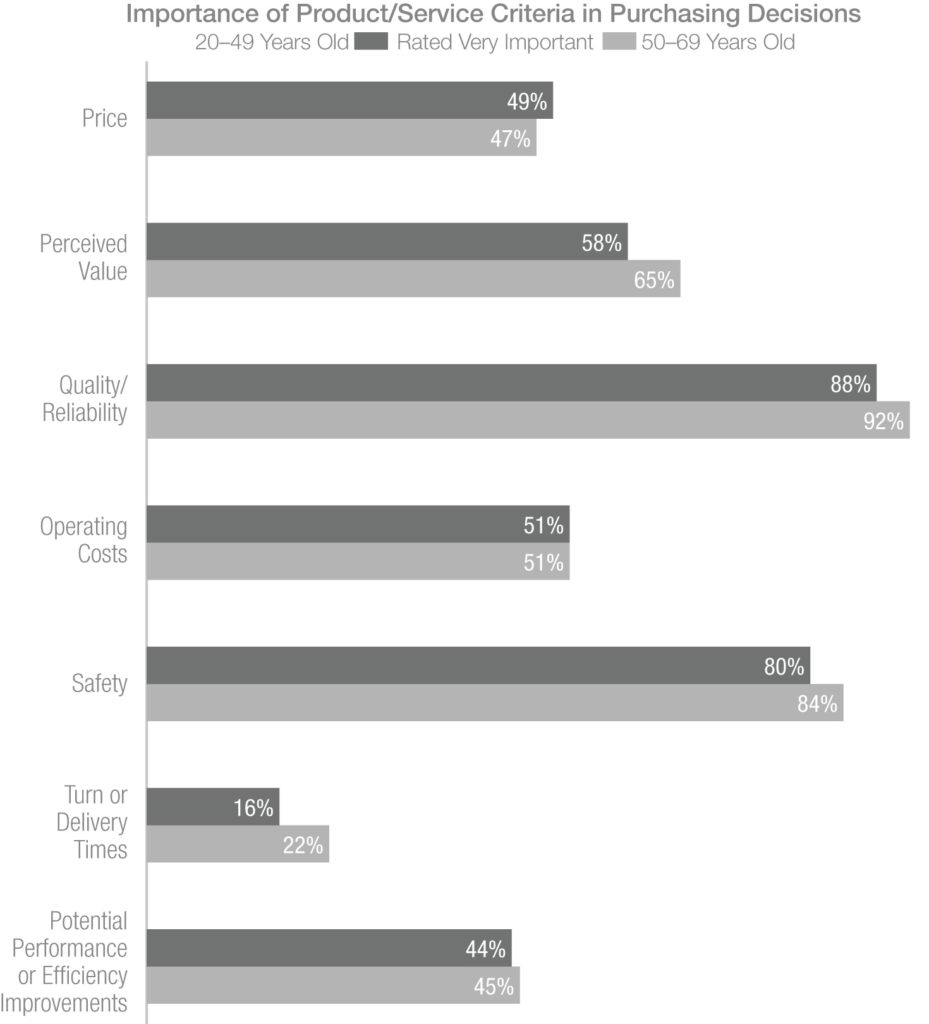

Moving on to look at the responses by age, we see that older and younger respondents generally value the same things.

Again, quality/reliability is first (and valued even more by older audiences) and safety is a close second. Perceived value is third, followed by operating costs and then price, which ranks much lower in importance overall. Potential efficiency improvements trail closely behind price, and turn/delivery times rank last, though they are slightly more important to older respondents.

Overall, people want the product to keep working, operate safely, represent a good value, and without costing a lot to operate — if they have to wait to get all of this, they will wait.

Based on this information, marketers should work to quantify and communicate the quality, reliability, safety and operating cost advantages of their products relative to their competition. Don’t make broad claims – use credible data and be specific to establish a clear competitive edge while shaping an overall perception of value.

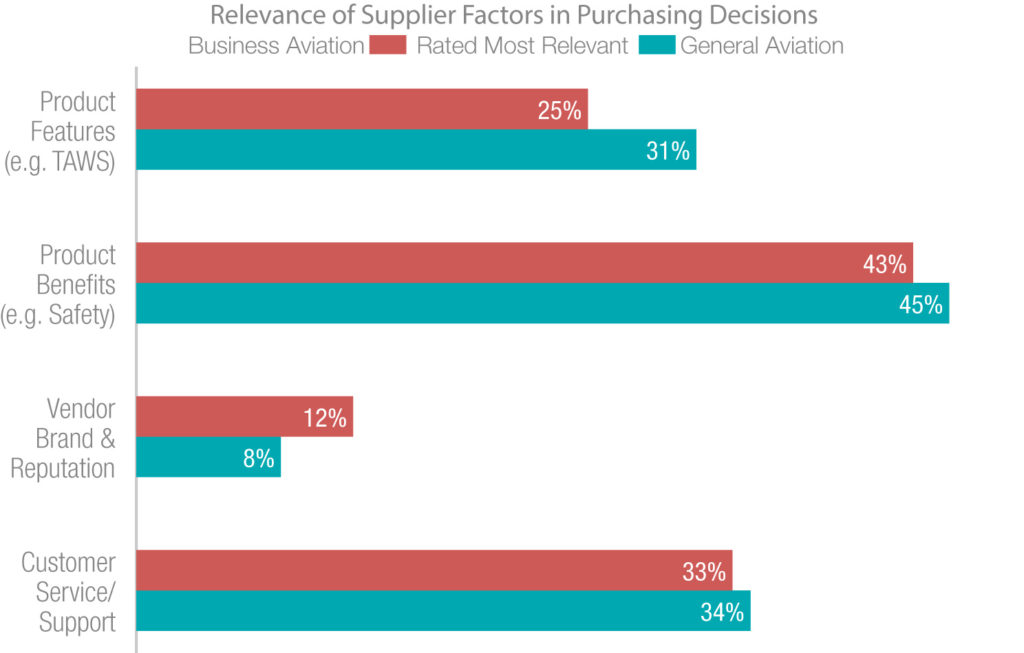

When considering supplier-related factors such as product features, product benefits, vendor brand/reputation and customer service/support, it’s again evident that there are few differences between BA and GA.

Product benefits, such as safety, rule as most relevant to purchasing decisions, followed by customer service and support.

Ironically, we see that many aviation marketers focus heavily on product features and company-centric messages — yet these are much less important to their buyers.

These results tell us that aviation marketers who focus on what their customers really care about, and do it in a way that clearly and credibly distinguishes them from other providers, will win every time.

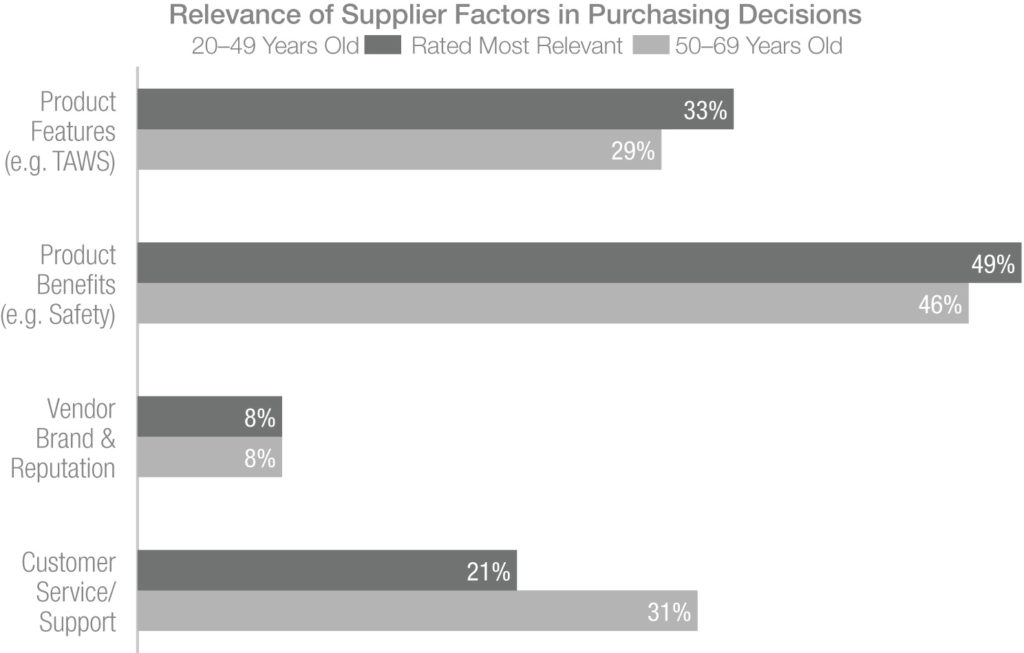

Looking at respondents by age, product benefits are still of top importance, and are even more important to younger buyers. Everyone values product features next, followed by customer service/support (which is substantially more important to those over 50).

Vendor brand/reputation ranks dead last, once again validating that buyers are benefit-oriented.

One could argue that a good brand is a shortcut to many of the features and factors that are preferred by respondents, but if we take them at their word, this survey sends a clear message to marketers about how to fine tune their marketing objectives, investments and messages for maximum effectiveness.

Coming up next week – from websites and data sheets to sales reps and dealers — find out what information sources are most influential in the purchasing process — and how those sources vary by market and age.

To further improve and approach your marketing in a more strategic fashion, download this easy-to-use marketing planner. It’s one of the most popular resources we offer.

Purchasing Behavior in GA & BA Part One: Demographics

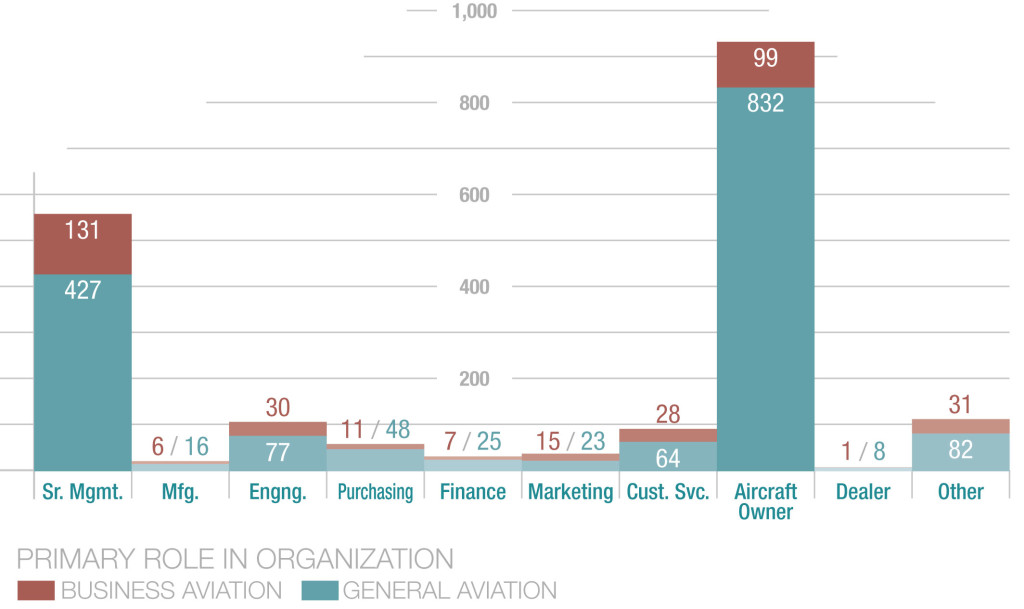

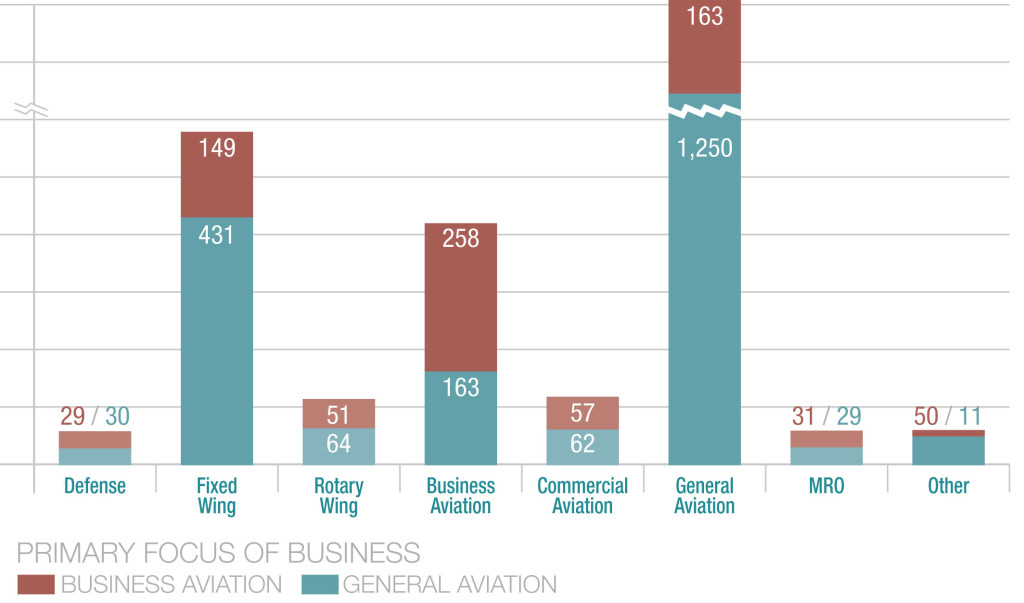

Working in conjunction with AVweb, BDN Aerospace Marketing recently surveyed 2,500+ general and business aviation professionals to better understand who they are, and how and why they make purchasing decisions.

Respondents ranged from self-described line pilots and private pilots to directors of maintenance and CEOs. All are involved in aviation, working in businesses ranging from real estate and security to agriculture, mining, software, architecture, construction and much more. It’s a diverse and interesting group that largely self identifies as purchasing decision makers. If you market to these individuals, this high-level overview should be helpful, and more details are available on request.

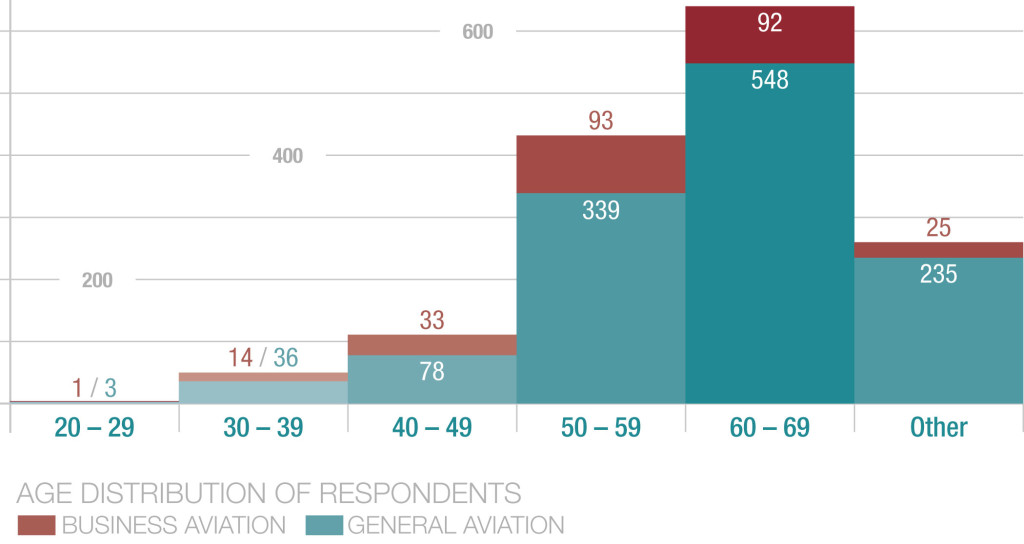

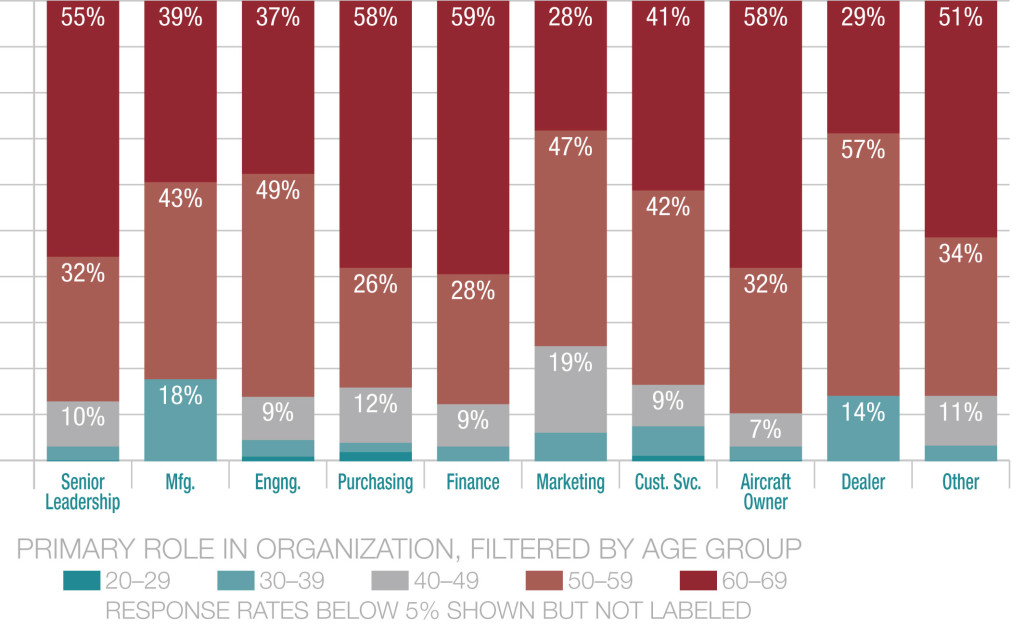

Today our focus is defining and understanding this group of respondents, and we will start by saying this: they are old. In fact, older than we expected, and as marketers, we must be keenly aware of this finding.

We already know that the GA and BA communities are aging. The Aircraft Owners and Operators Association (AOPA) reports that between 1990 and 2010, the average age of U.S. pilots, for example, increased from 40.5 to 44.2, and that number continues to rise, “posing serious challenges for the industry.” Our respondents, who represent more than just pilots, were older still. Those in business aviation are notably younger than those in general aviation, but still aging. Less than 20 percent of the BA respondents are under 50 and that number drops to less than 10 percent for GA.

In the group surveyed, the vast majority of respondents were 50 or older, but that doesn’t mean we can ignore the under-50s. These younger people do play a role as influencers and decision-makers, and we need to understand and market to them now, preparing for the time when they represent the majority.

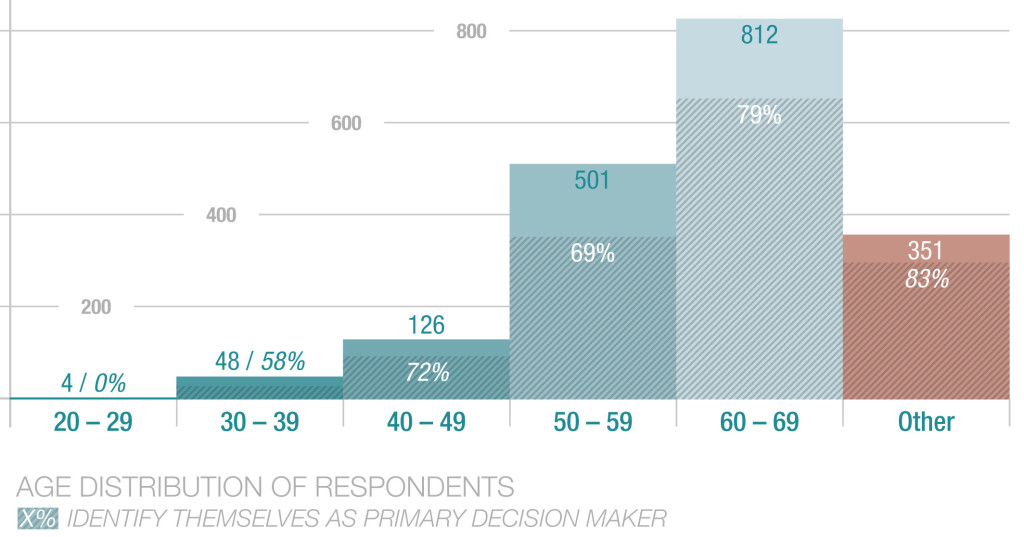

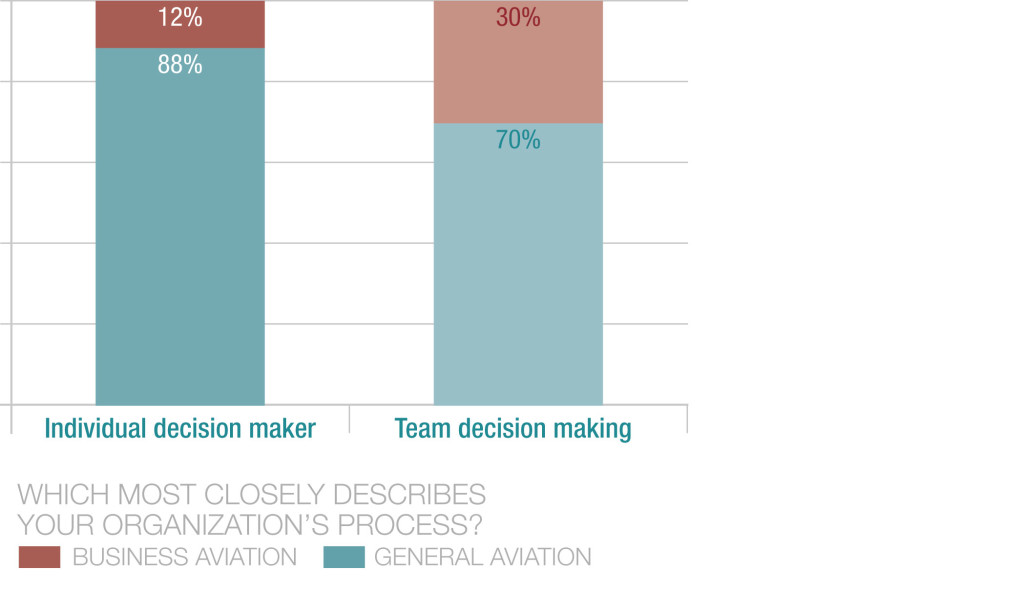

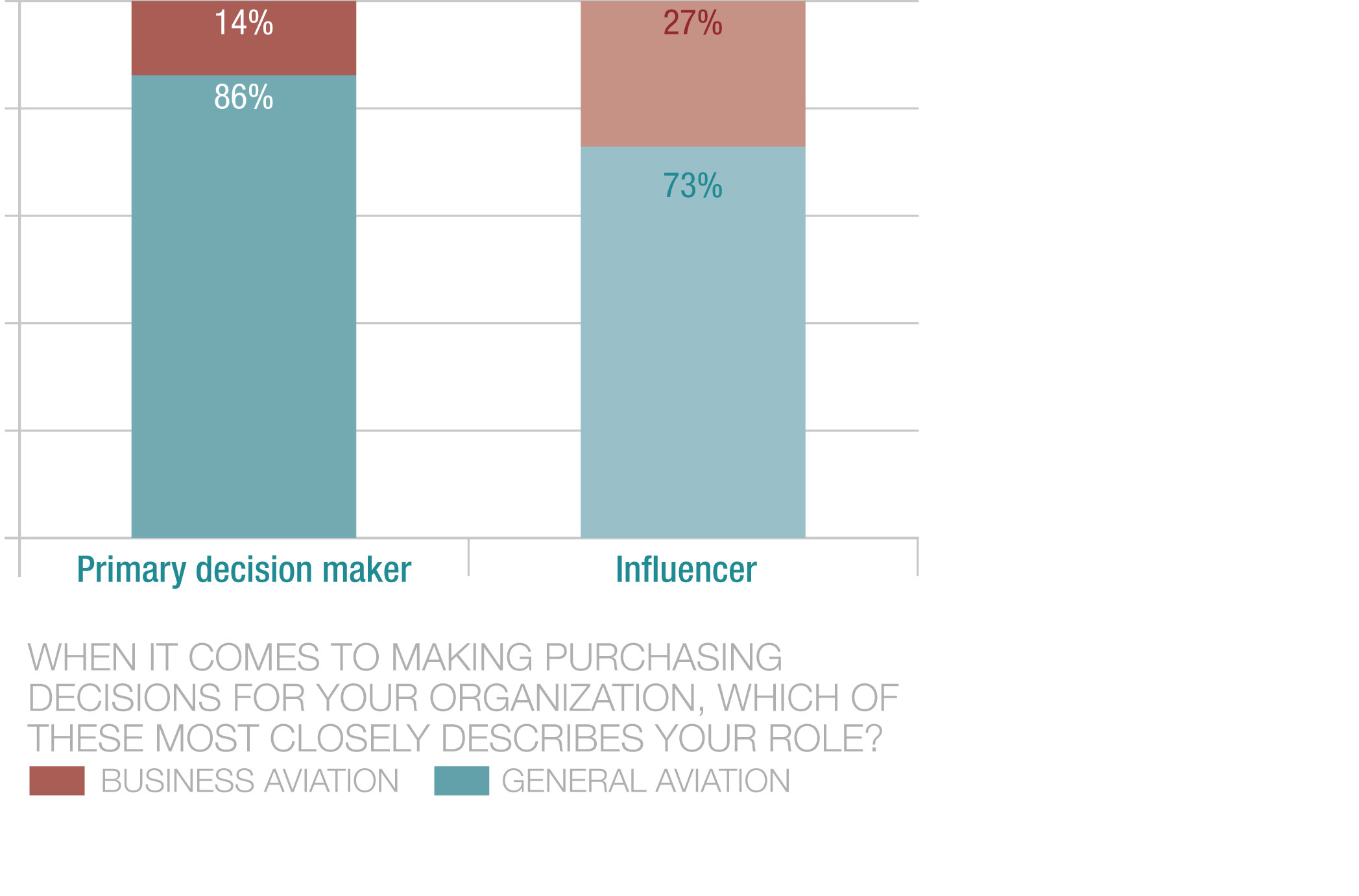

Older respondents in GA are much more likely to be part of an organization with an individual decision maker and to describe themselves as a primary decision maker.

While there is much more team decision making within the BA segment, about half of these respondents say they make the final decisions. Further analysis showed that younger respondents are more likely to describe themselves as influencers in an organization where team decision-making is the norm.

Based on all of these findings, marketers looking for quicker sales in either segment may want to focus on older prospects who are generally better off financially and are also in a position to make individual decisions without team or committee consultation.

Younger respondents (those under 50) tend to have a larger presence in functions such as manufacturing, marketing and with dealers. Fifty-somethings are strong in engineering, marketing and with dealers. And the oldest respondents dominate senior leadership, finance, purchasing and procurement and aircraft ownership.

Not surprisingly, aircraft owners and operators dominate GA while there are a significant number of self-described senior leaders in BA. Once again, the older prospects are likely to be the most attractive targets for marketers, depending on what is being sold.

Survey findings are most reflective of respondents with a focus on fixed wing businesses in the GA and BA segments, but rotary wing and commercial aviation were relatively well represented. If you market to these groups, this information should prove valuable.

Coming up next week: See what respondents value most in products, in services, and in suppliers (hint: it’s not brand or reputation) and see how priorities change based on age and market segment.

To further improve and approach your marketing in a more strategic fashion, download this easy-to-use marketing planner. It’s one of the most popular resources we offer.

7 Research Questions that Can Change Your Marketing Forever

BDN believes in research both for the industry and for our clients. And you should, too.

Please don’t discount research because you think you understand your audience. No one in our field can afford to base marketing decisions and investments on guesswork or assumptions about audience definition, needs and preferences. You have to know.

This Forbes article, “Why Knowing Your Audience is the Key to Success,” advises that “a solid market research campaign plays an important role in a successful marketing initiative by giving you the information you need to focus in on your audience and content.” And that’s really the point — gathering the right information to make your marketing more effective.

However, research is a complex topic that should not be approached lightly. If you’re thinking about conducting research of your own, it’s important to ask the right questions. Whether you are doing one-on-one interviews, focus groups, or an online written survey, here are 7 types of questions you’ll want to include in your research initiative.

- Who, specifically, are the decision makers for purchasing your products/services? Procurement people? Pilots? Maintenance personnel? Others? Prioritize them, separating by market segment if needed.

- What role do they play in purchasing decisions? Are they influencers? Sole decision-makers? Part of a committee or team?

- How do your targets make decisions? What factors are most important to them? Do they value price above all else? Strive to understand everything you can about their decision-making process and tailor your marketing to match.

- What are the demographics of your audience? Consider asking about gender, age, and geographic location, for example. Cross-tabulating this information with other findings can provide valuable insight.

- What does the audience know or believe about your company and products versus competitive offerings? Are they aware of your business and product line? Do they have a positive impression? Understanding awareness and perceptions will fundamentally shape your campaign strategy and tactics.

- What are the pain points, problems and challenges they face? For example, if they are challenged by unreliable products — and if reliability drives their decision-making — you have gained a valuable leverage point that can set you apart from the competition. Also, consider including an option for respondents to write in comments. These can be incredibly helpful.

- Where and how do they learn about products and services that may be of interest to them? From Google to advertising, print collateral to dealers, learning what channels are most influential can guide how and where you invest limited marketing budgets.

Want to learn more? Don’t miss this in-depth piece from B2B International.

And watch this space next week, when we begin presenting original research detailing how purchasing decisions are made within the general and business aviation markets.