Category: Research

Audio: Lead Generation Case Study

This Marketing Flight Manual is downloadable audio content.

Is lead generation important to your business? This week, we sit down with Business Development Executive Ashley Cutler and VP of Client Services Lisa Sifuentes as they discuss their efforts on a recent lead generation campaign with host and Senior Designer Nick Markwardt. As you will hear, the results were nothing short of astounding.

Play this week’s session below or click here to download the MP3.

The full case study, including additional metrics and tips for improving your own lead generation efforts, will be available for download here on the Marketing Flight Manual next week.

[vc_separator type=”” size=”” icon=”plane”]

Lead Generation resources you might also be interested in:

Trends and Challenges in Aerospace Marketing: ‘We Need More Support’

Last week we brought you research data and insight about trends impacting aerospace and defense marketers.

Last week we brought you research data and insight about trends impacting aerospace and defense marketers.

This week we continue that theme with verbatim comments from more than 30 survey respondents who wrote about their experiences in aerospace marketing. Here are the challenges, opportunities and trends they shared.

Market Conditions and Budgets

“Our biggest challenge is volatility within the industries where we work, specifically petroleum exploration.”

“The downturn in defense and aerospace has management looking to decrease marketing expenditures.”

“A decline in sales is dramatically impacting marketing resources. I am hopeful that the industry will rebound over the next few years.”

“Larger companies have more influence and are moving the market away from our solutions.”

“We are challenged by collapsing markets due to the global economy.”

“It seems our business is very much influenced by politics and whatever the current budget constraints that are in play.”

“We have too much ground to cover and not enough people or time to adequately address.”

“Our primary challenge as a small aviation electronics manufacturer is developing marketing programs around a changing product line that is undergoing constant timeline and feature revisions due to limited staff. Deadlines keep getting pushed back and budgets reduced due to delays in getting product to market.”

“Lack of funding limits our team and our messaging approach.”

“Marketing requires a sizeable investment of cash.”

“Due to tough economic times, budgeting for all required needs of a company can be tough. We use as many free social media and website resources as possible to help reduce costs associated with marketing.”

“Too much spending is required for trade shows and events that never go away. There are more every year.”

Insights: Budgets and resources are clearly a concern for our industry. Last week’s survey results revealed widespread under-spending, and the verbatim comments are in line with that assessment. Respondents also voiced concerns about the state of the industry, citing declining market opportunities as a prime challenge. With downturns in the business aviation, rotorcraft and defense segments, this is a very real challenge that must be addressed. But why are so many companies cutting marketing when sales are down? It defies logic. Because just as food is the fuel that helps us remain healthy and thrive, marketing is the fuel that is essential for business success. Without it, our businesses will weaken, wither and die. If marketing is the engine that powers your business, is it really the area to cut corners or to settle for a makeshift solution?

Resource: This white paper has more information about how much companies should budget for marketing, with benchmarks and industry data you need now.

Targeted Marketing to Reach Decision Makers

“Getting in front of decision makers is a challenge. Everyone understands our business and how it may be used to leverage their efforts, but the decision makers are buried in white noise from everything else.”

“In my business, marketing means selling ideas to customers and obtaining funding for those ideas. They are not for public dissemination, so marketing is very selective and done on a one-on-one basis vs. broadcasting. As we gain ground in funded projects and create products for sale, marketing will become somewhat more traditional, but still very selective, and the objective targets will be contacted via personal measures.”

“It’s tough to break through the clutter of email and offers.”

“I see a lot of money being spent on non-productive initiatives. As a small niche consulting firm, we would only be served by targeted marketing to a few potential prospects.”

“It’s extremely difficult to get a foot in the door with the right people. Sending emails offering support and adding value with our quality products and services to try to get new customers is completely ineffective. We’ve hit a wall as far as generating new leads.”

Insights: Aerospace industry marketers are generally fortunate to have a clearly defined audience of potential customers and influencers. Being highly targeted in this way should make our jobs easier, right? Yet time and time again we hear from marketers who are frustrated with their inability to reach decision makers. If this is a challenge you face, we suggest that you start by questioning your diagnosis. Are you sure that you are not reaching the right people? Or is there a problem with the messaging? Is the delivery method wrong? What do your analytics tell you? An abundance of aerospace marketing is company-centric, focusing too much on what the company does, and too little on how it will make the customer’s life better. Get to the root cause of the problem and you’ll be one step closer to a real solution.

Resources: If your goal is to do business with OEMs, this blog, “The Truth About Marketing to Aerospace OEMs,” details six specific steps to connect with your target audience. Or, download this related infographic, “How to Gain Visibility with OEMs.” Are you working to generate more leads? Check out “Four Keys to Lead-Generation Success.”

Need for Measurement

“We are unable to measure return on investment effectively or directly.”

“On the general aviation side, finding ways to cost-effectively measure ROI and leads remains a challenge. The industry is specialized enough to warrant a more customized approach (software, etc.) but too small to really afford it, so a patchwork of systems is created.”

“Creating meaningful content, with enough depth and technical information to satisfy the customer, is a challenge. We also lack marketing team resources and the ability to justify ROI to the CFO.”

Insights: Measuring the impact of marketing is possible – it’s just not easy. Take advantage of the many resources and tools available to help you establish and build a process that will work for you and your company. And remember, calculating ROI is simply the cost of a sale subtracted from the profits on that sale, divided by the profit number (and expressed as a percentage).

Resources: While we do not endorse any single program or provider, explore these resources to learn more about how to measure your marketing effectiveness: Marketingprofs, Lenskold, Marketingmo, or Marketo.

Embracing New Approaches & Fresh Ideas

“Keeping up with social media is a challenge since it morphs easily into other avenues that may or may not be readily addressed.”

“Personal relationships and prior customers form the basis of our support. It’s tough to break the 30-year mold of “what we have done in the past” to get senior management buy-in on newer marketing trends and strategies. We also don’t have anyone with a formal marketing background to help us stay current and continually engage our market sector. We also don’t have a large budget for marketing. We are in the black hole of business development.”

“Most marketing efforts are run of the mill, with everyone using the same idea or concept.”

“People don’t think outside the box enough. A great deal of advertising and publication content is flat and lifeless.”

Insights: We often hear from aerospace marketers who feel their work — or that of their outside provider — has become stale. Many others say that they are overworked, overwhelmed and simply unable to keep up with the new tools and technologies that are revolutionizing our profession.

Resources: Get your marketing program back on track with inspiration from this fact-filled infographic, “12 Secrets to Marketing Success.” Do something different! From live chat to drones, here are 10 fresh ideas to breathe new life into a marketing program that has grown stale. Some businesses find that external support is a good fit for their needs; other times it’s not the best option. This white paper, “Is it Time to Hire an Outside Marketing Firm?” can help you find the approach that’s right for you.

Other Comments & Concerns

“Online tactics and properties are key to our marketing strategy, but using an old-fashioned direct approach (postcards) is also successful. We were staff-challenged last year, but have since staffed up. This allows us to focus on our biggest asset, our website, while also pursuing direct marketing. Supplying good content and imagery is always an issue with a smaller budget. Managing an integrated marketing program with many moving parts and deadlines is a challenge, and it’s hard to know whether a marketing management application will really help, or end up becoming the work. We have also been challenged measuring ROI for activities, but have determined that a contributory methodology is likely the best. We look at what activity contributed to a sale versus pegging a sale to one activity — something that is very difficult to do in B to B marketing.”

“Social media does not reach 59-65 year-old C-level executives.”

“Our major challenge is getting corporate approval for website redesign. The current site is ancient, has insufficient content, and is hard to navigate.”

“I see many smaller niche print and digital publications refusing to cover a newsworthy product launch just because the company is not an advertiser. We are finding that editorial is being driven a lot more by advertising sales input — at least for smaller market media.”

“Our real issue is how to be more efficient.”

“It’s hard to convince anyone that I’ve spoken to in aerospace that image, and how they present themselves, matters.”

“Building brand awareness for new or merged brands is always a challenge.”

What are your marketing challenges, issues and concerns? We’d love to hear from you and welcome all questions and comments!

7 Discouraging, Surprising, Yet Hopeful Truths About Modern Aerospace Marketing

BDN routinely uses research to understand, benchmark and report the trends and realities impacting the work we do as aerospace marketers.

In our most recent survey we asked aerospace marketers questions about their approach to budgeting and planning, goal-setting, goal accomplishment, their most effective tools and techniques, and levels of satisfaction with their company’s marketing performance.

We wondered, “Is there a correlation between those who plan and those who get results?” “Are some tactics consistently much more effective than others?” And, “Do budgets equate to higher perceived performance?”

It turns out that the answer is yes to all these questions, yet there is still much to be learned. Today we are providing a high-level summary of our findings with key takeaways and insights that shine a light (not always a flattering one) on our industry and our profession. This is ideal for those who want a quick read.

Anyone who would like more in-depth charts and findings may request the complete survey results here.

And remember, these results are suggestive, not scientific.

Key Insights & Takeaways

Finding: Regardless of their annual revenue, aerospace companies are still under-spending on marketing, with many high-revenue businesses spending just as little as their lower-revenue counterparts.

Insight: Shame on us. It’s hard to believe, but 20% of the $100,000,000 businesses have marketing budgets under $100,000. That’s an embarrassingly small .001%, and far below recommended spending and benchmarks for both B2B and our industry.

Takeaway: The budgeting process in larger companies sometimes defies logic, with decision-makers removed from the realities of individual functions. Verbatim comments tell us that more than a few companies are actually cutting marketing because industry conditions are bad. Huh? Marketers who work for an organization like this can either use data and measurement to become agents of change from within, remain ineffective, or run.

Finding: Most marketing budgets have stayed the same since 2015; a good number have increased; and very few have been cut.

Insight: Yes, this is positive news, but remember, budgets are still below accepted standards. Harvard Business Review generally suggests investing 3% of revenue in marketing, with adjustments made for specific scenarios.

Takeaway: Management probably believes marketing has everything it needs to be successful. After all, they have added or maintained existing budgets. But we can and must do better. If you are working with a limited budget, stop defaulting to old school tactics that can’t be measured — and when management wants you to do the same old, same old, explain that you can’t afford anything that fails to deliver ROI. Position yourself as the expert and start showing results to upper management that will justify the higher budget you know you need.

Finding: The majority of respondents say they do have and follow a marketing strategy and plan, yet there are striking differences here based on company revenue. More than 90% of the largest companies have a plan; less than 50% of the smallest do.

Insight: The survey shows that those with a strategy and plan are more satisfied with their company’s marketing performance than those without. It also shows that, as spending levels rise, so do levels of satisfaction with overall marketing performance.

Takeaway: A strategy, plan, adequate budget and measurement are the keys to your marketing success, regardless of company size. But if you are working with a smaller budget, strategy and planning become even more critical to ensure that every dollar spent is associated with an expected, measurable outcome.

Finding: Most respondents reported success in accomplishing key objectives. Improved brand awareness, improved customer engagement/relationships and increased sales were most frequently cited. Interestingly, 12% of those spending less than $100,000 report that they accomplished none of their objectives last year – no one spending $1 million or more said they accomplished nothing.

Insight: Regardless of budget, brand awareness and leads were cited as top successes. Because brand awareness is more difficult to measure it may be a more comfortable “metric” for some marketers. Challenge yourself to achieve more measurable objectives moving forward.

Takeaway: People are reporting success, and that’s good. Let’s just make sure those claims of success are based on data you can defend.

Finding: The most effective digital marketing efforts were websites (83%) and email marketing (79%). The highest marks for ineffective tactics were social media, blogs and online display ads, yet plenty of marketers also found them effective.

Insight: One, people are divided about what works in the digital realm. Also, while websites are recognized as effective, less than 50% say their SEO is effective.

Takeaway: We think the sheer volume of new and changing tools and options overwhelms many marketers. The first step to using the right digital tactics is understanding them – make time to get smart and use data to determine what is and is not working.

Finding: The most effective traditional marketing efforts were events and print advertising, yet print advertising also was most frequently called out as ineffective.

Insight: We continue to rely on old school tactics, perhaps to appease older, old school management, that are less likely to be measured.

Takeaway: If you are using events and print advertising (often the most expensive tactics) make sure you are tracking results. There are tools and techniques that make it possible to know if these approaches are working.

Finding: In 2016, marketers overwhelmingly say their No. 1 objective is increasing sales, followed by improved customer engagement, increased leads and improved brand awareness. Also, their No. 1 challenge is acquiring new customers, followed by lead generation and measuring ROI.

Insight: Hurray! Marketing exists to drive sales, and we are heartened to see folks acknowledging this connection.

Takeaway: Take a look at the relationship between marketing and sales in your organization. Are you using a CRM and marketing automation system to facilitate tracking, measurement and accountability? Are you working harmoniously toward a common goal? Or is there friction and finger pointing? Make mending and strengthening these relationships — adding in accountability for everyone — a priority for the good of the business.

Next up:

Keep reading next week for verbatim comments from more than 30 respondents who wrote to us about the challenges, opportunities and trends they are experiencing in their aerospace marketing work.

Don’t forget:

If you liked this blog post, you may also be interested in these free BDN resources:

- How to Develop a Marketing Communications Budget

- Budget Planning Checklist

- Marketing Planner

- 30 Days to Better Digital Marketing

How to market and sell to GA and BA audiences

This final installment in our series on purchasing behavior in General Aviation (GA) and Business Aviation (BA) seeks to better understand the marketing tactics that are likely to be most effective with these audiences.

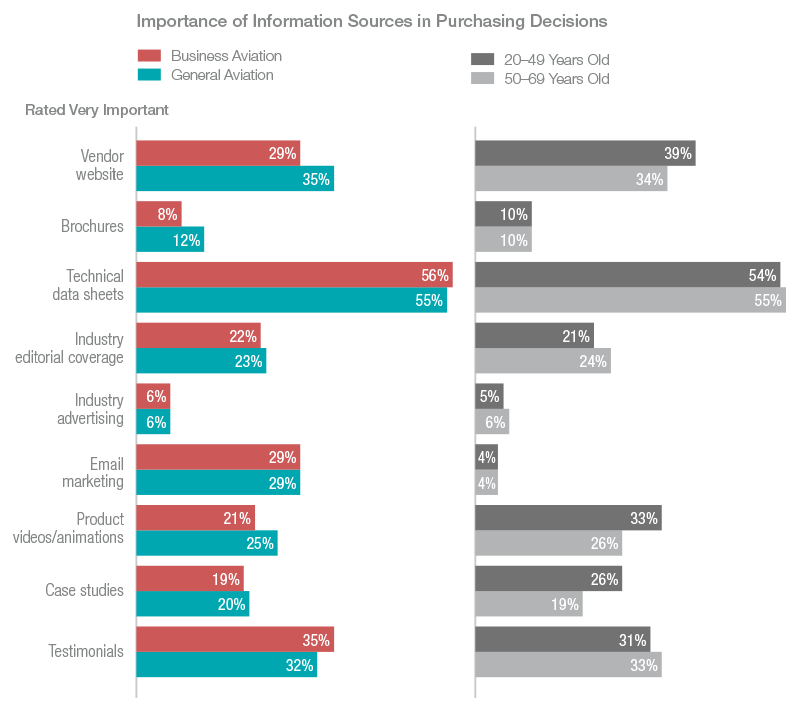

We asked respondents to rate the importance of various information sources they may reference during the decision-making process and were surprised to learn that technical data sheets are strongly favored, regardless of age or market segment. Fifty-six percent of respondents consider data sheets very important, and an additional 35% see them as moderately important — that’s 91% of respondents.

Regardless of age or market, respondents also value testimonials, vendor websites and product video/animations, but industry advertising ranks dead last with all groups surveyed.

How much of your marketing budget is devoted to advertising or brochures? If you are spending a significant amount on these items it might be time to reconsider and reallocate to other resources that buyers find more important.

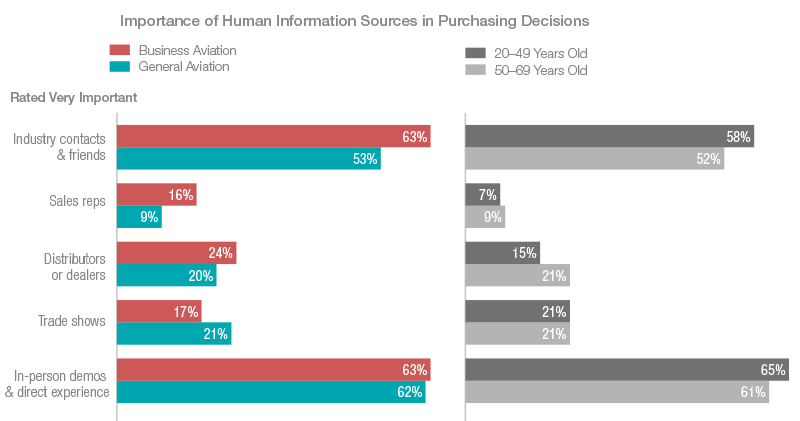

Who, among human information sources is least valued? Sales reps. Only 9% on average consider sales reps very important. In-person demos or other direct experience rates the highest, followed closely by industry contacts and friends. Distributors or dealers and trade shows fare only slightly better than sales reps. We were most surprised by the rather mediocre performance of trade shows, especially with the BA respondents, who also place greater value on their industry contacts and friends than do the GA respondents.

It turns out that no one, regardless of age or market segment, wants to be sold, either by sales reps, or dealers, or at trade shows. This tells us that an inbound marketing approach, where businesses draw customers to them by providing helpful content (and not sales pitches), could have great utility and value for aviation marketers.

We also asked respondents what resources they refer to during their consideration and evaluation process prior to making a purchase. All respondents prefer to speak with trusted colleagues over Google searches and referencing company websites. BA respondents place more value on their existing knowledge, while print and digital magazines rank last with everyone.

But when you whittle down those choices and ask respondents to pick just one resource, speaking with trusted colleagues is picked 43% of the time, followed by a big drop to 14% using Google, then about a 50% drop to the other “top” choices such as website, existing knowledge and magazines.

As we keep seeing throughout this series, people trust their own experiences and the opinions of friends and colleagues; performance is king; brands are not important; and no one wants to be sold.

For marketers, the keys to the kingdom are in finding ways to allow more people to use the product/service and then turn those users into unpaid evangelists. Work hard to make non-sales-y, factual and data-driven information available via multiple channels, including the web. And look carefully at the investment being made in trade shows, brochures and advertising. You may find it wise to re-allocate some of those funds to product demos, content marketing or referral programs.

To learn more about buying behavior in GA and BA, reference the other blogs in this series here and here. To subscribe to this blog and enjoy weekly email delivery, click here.

To approach your marketing in a more strategic fashion, download this easy-to-use marketing planner. It’s one of the most popular resources we offer.

Decision-making factors in the aviation buying process

The May 10 Flight Manual focused on understanding the characteristics of purchasing decision makers within the business aviation (BA) and general aviation (GA) markets.

This week we dig deeper still to gain insight into the product and supplier factors that most influence their buying decisions. This goes to the heart of what buyers value most, so it’s directly relevant to those who market and sell to these audiences.

Looking at responses by both age and market we learned that, with a few exceptions, buyers tend to value the same things regardless of age or segment.

This is a somewhat high-level generalization, and we will highlight points of difference, but there are clear trends and preferences that apply across the board. It’s clear that people in these markets are more similar than they are different. Let’s take a closer look.

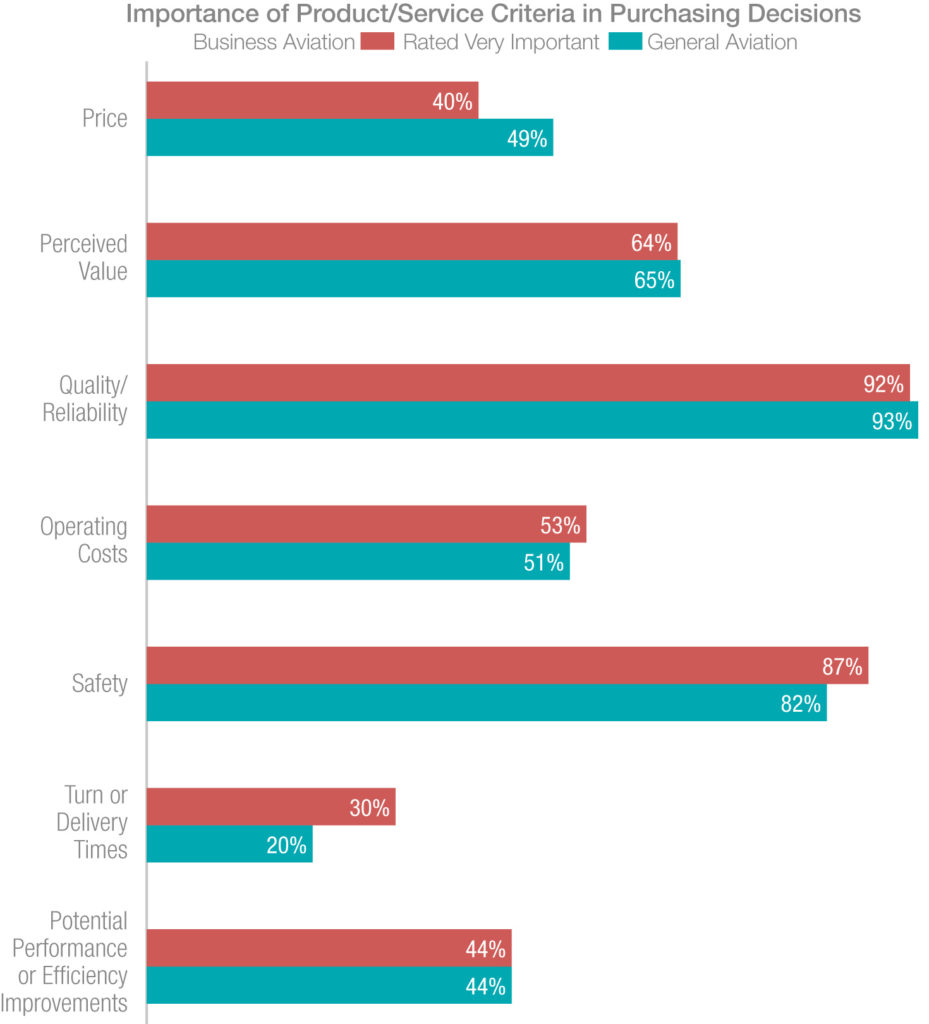

We asked respondents to rank the importance of various product and service criteria in their purchasing decision-making process. These criteria included price, perceived value, quality/reliability, operating costs, safety, turn/delivery times, and potential performance or efficiency improvements.

Both market segments are most concerned with quality and reliability, closely followed by safety, which was even more important to business aviation respondents.

While price is more important to GA, it is not the most important factor. In fact, it is similar in importance to efficiency improvements, and both are trailed by turn/delivery times, which matter more to BA than GA.

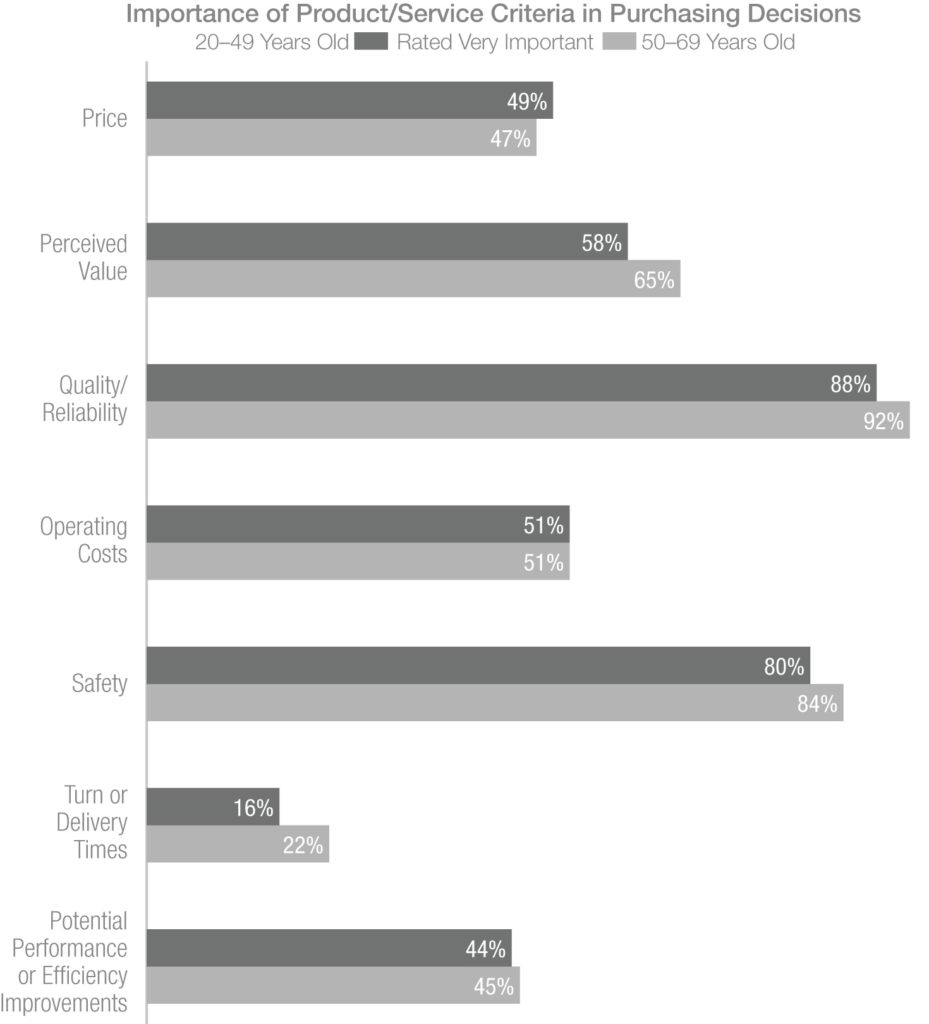

Moving on to look at the responses by age, we see that older and younger respondents generally value the same things.

Again, quality/reliability is first (and valued even more by older audiences) and safety is a close second. Perceived value is third, followed by operating costs and then price, which ranks much lower in importance overall. Potential efficiency improvements trail closely behind price, and turn/delivery times rank last, though they are slightly more important to older respondents.

Overall, people want the product to keep working, operate safely, represent a good value, and without costing a lot to operate — if they have to wait to get all of this, they will wait.

Based on this information, marketers should work to quantify and communicate the quality, reliability, safety and operating cost advantages of their products relative to their competition. Don’t make broad claims – use credible data and be specific to establish a clear competitive edge while shaping an overall perception of value.

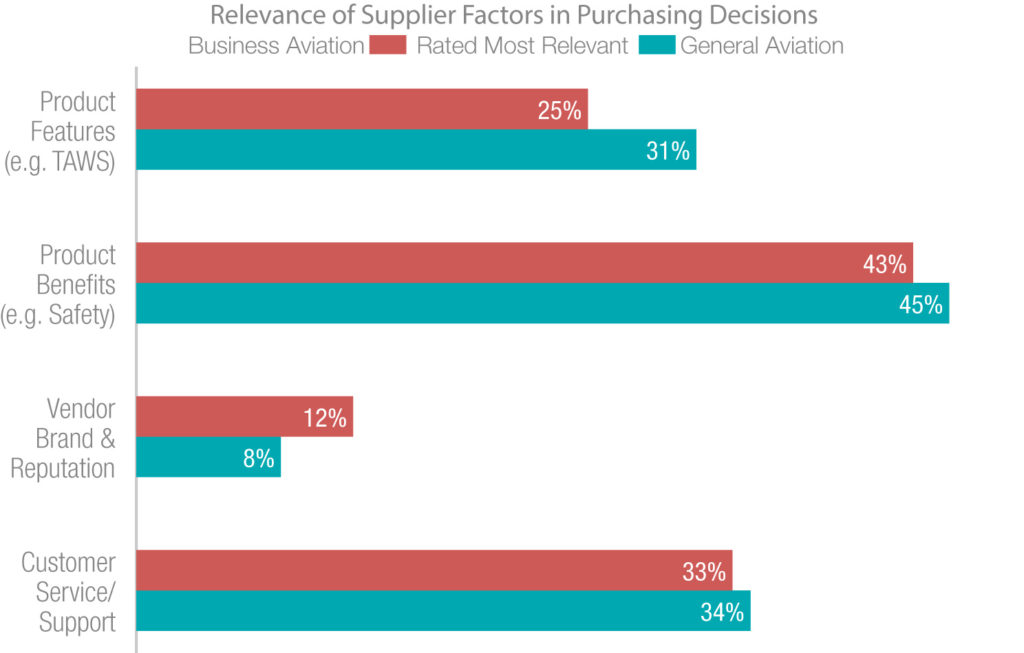

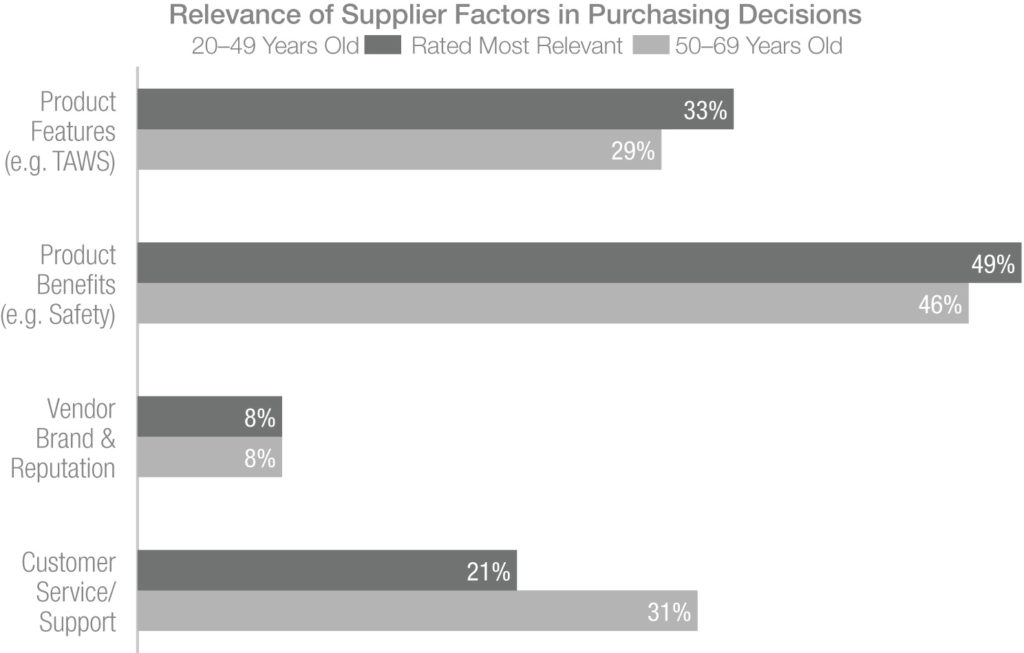

When considering supplier-related factors such as product features, product benefits, vendor brand/reputation and customer service/support, it’s again evident that there are few differences between BA and GA.

Product benefits, such as safety, rule as most relevant to purchasing decisions, followed by customer service and support.

Ironically, we see that many aviation marketers focus heavily on product features and company-centric messages — yet these are much less important to their buyers.

These results tell us that aviation marketers who focus on what their customers really care about, and do it in a way that clearly and credibly distinguishes them from other providers, will win every time.

Looking at respondents by age, product benefits are still of top importance, and are even more important to younger buyers. Everyone values product features next, followed by customer service/support (which is substantially more important to those over 50).

Vendor brand/reputation ranks dead last, once again validating that buyers are benefit-oriented.

One could argue that a good brand is a shortcut to many of the features and factors that are preferred by respondents, but if we take them at their word, this survey sends a clear message to marketers about how to fine tune their marketing objectives, investments and messages for maximum effectiveness.

Coming up next week – from websites and data sheets to sales reps and dealers — find out what information sources are most influential in the purchasing process — and how those sources vary by market and age.

To further improve and approach your marketing in a more strategic fashion, download this easy-to-use marketing planner. It’s one of the most popular resources we offer.

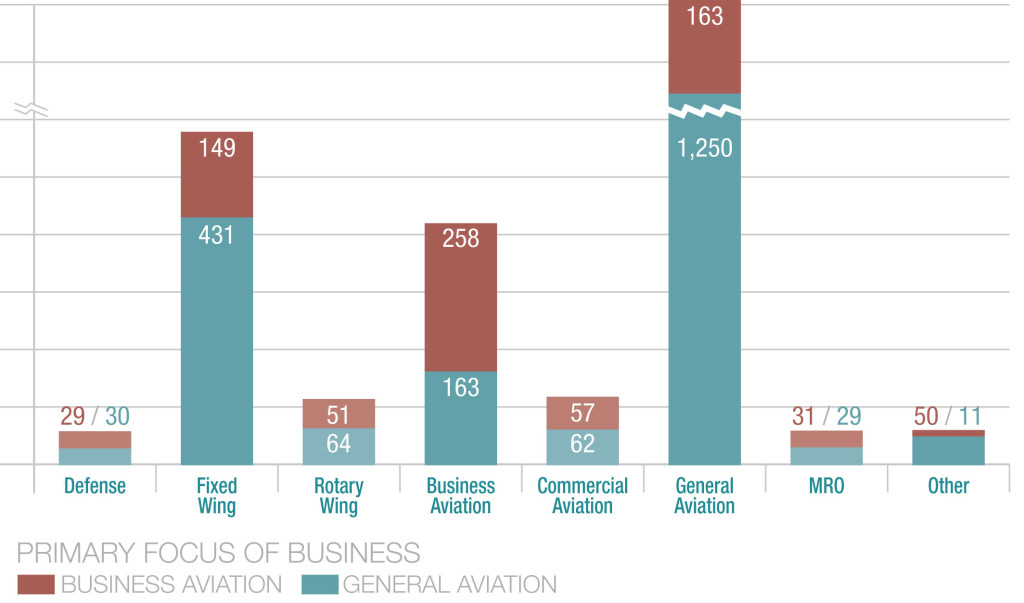

Purchasing Behavior in GA & BA Part One: Demographics

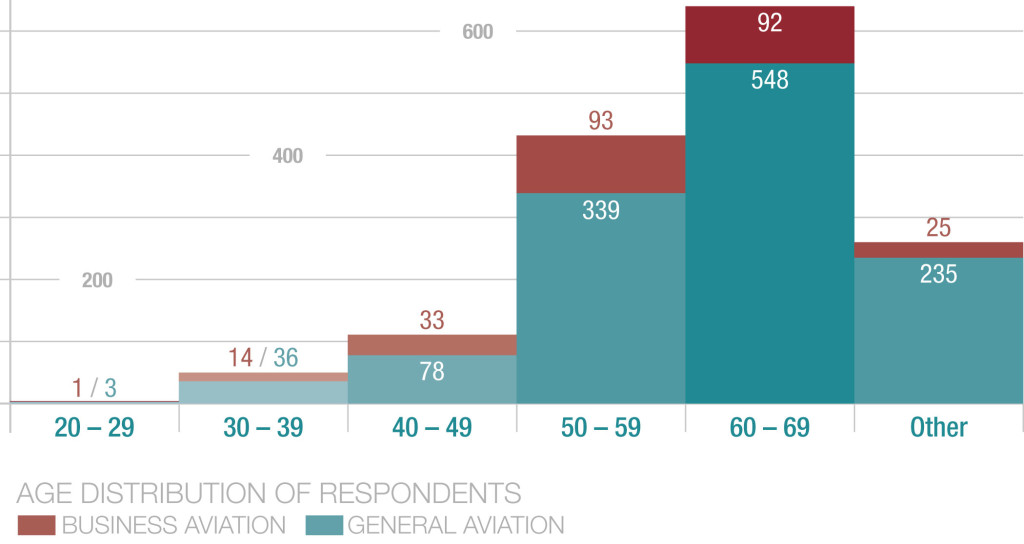

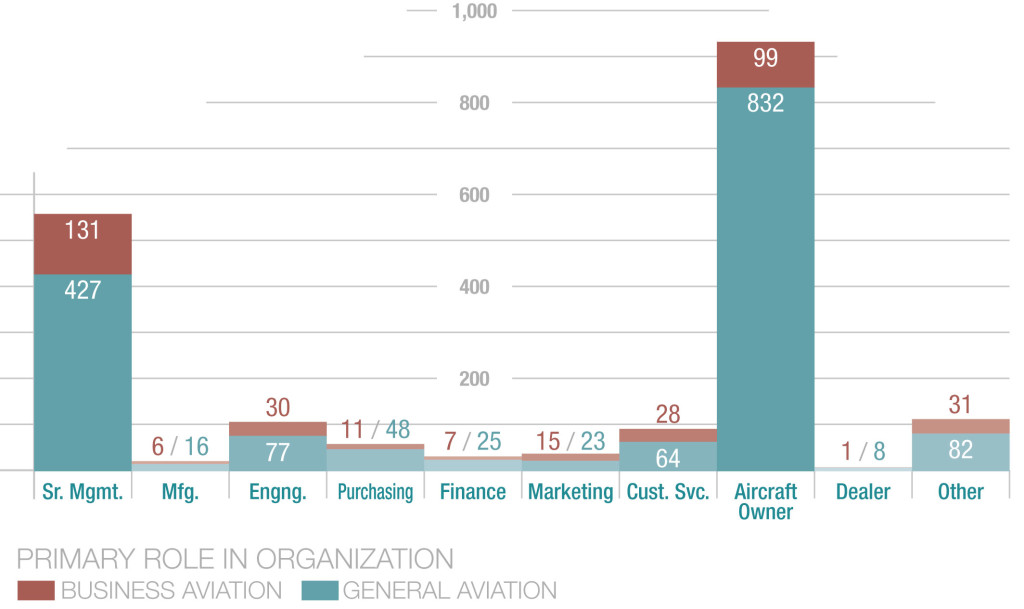

Working in conjunction with AVweb, BDN Aerospace Marketing recently surveyed 2,500+ general and business aviation professionals to better understand who they are, and how and why they make purchasing decisions.

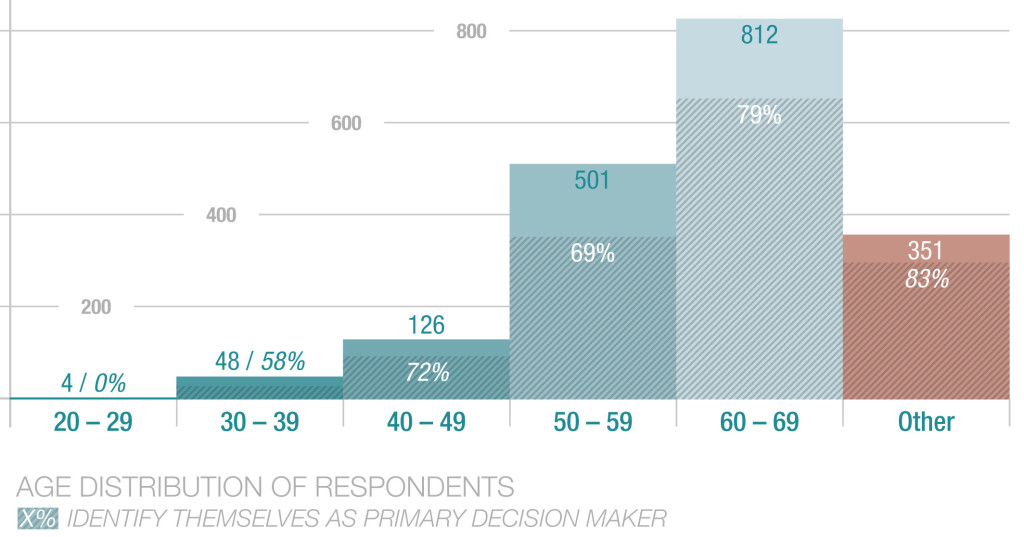

Respondents ranged from self-described line pilots and private pilots to directors of maintenance and CEOs. All are involved in aviation, working in businesses ranging from real estate and security to agriculture, mining, software, architecture, construction and much more. It’s a diverse and interesting group that largely self identifies as purchasing decision makers. If you market to these individuals, this high-level overview should be helpful, and more details are available on request.

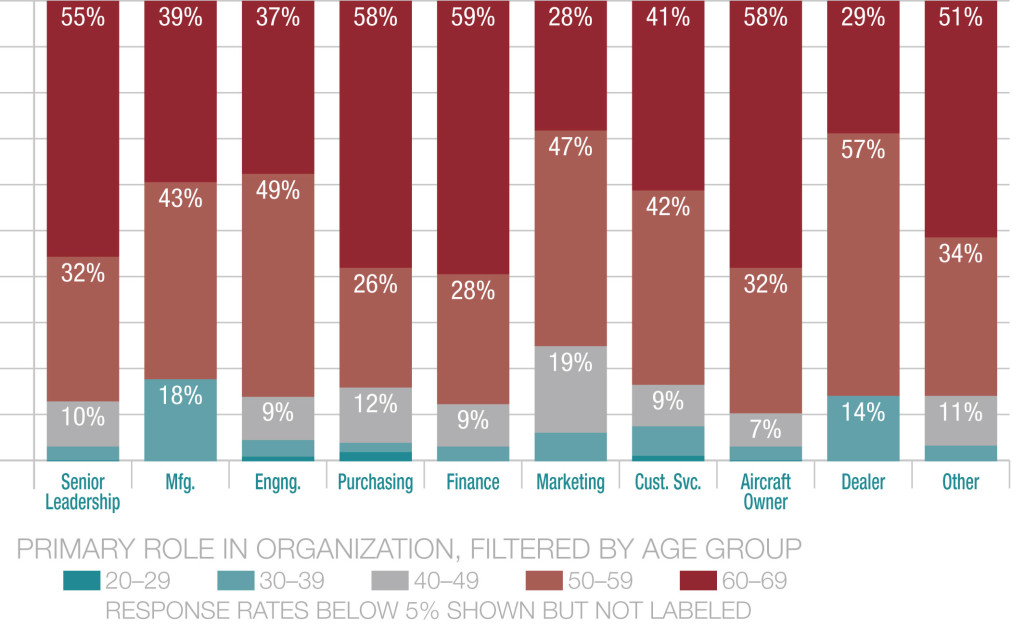

Today our focus is defining and understanding this group of respondents, and we will start by saying this: they are old. In fact, older than we expected, and as marketers, we must be keenly aware of this finding.

We already know that the GA and BA communities are aging. The Aircraft Owners and Operators Association (AOPA) reports that between 1990 and 2010, the average age of U.S. pilots, for example, increased from 40.5 to 44.2, and that number continues to rise, “posing serious challenges for the industry.” Our respondents, who represent more than just pilots, were older still. Those in business aviation are notably younger than those in general aviation, but still aging. Less than 20 percent of the BA respondents are under 50 and that number drops to less than 10 percent for GA.

In the group surveyed, the vast majority of respondents were 50 or older, but that doesn’t mean we can ignore the under-50s. These younger people do play a role as influencers and decision-makers, and we need to understand and market to them now, preparing for the time when they represent the majority.

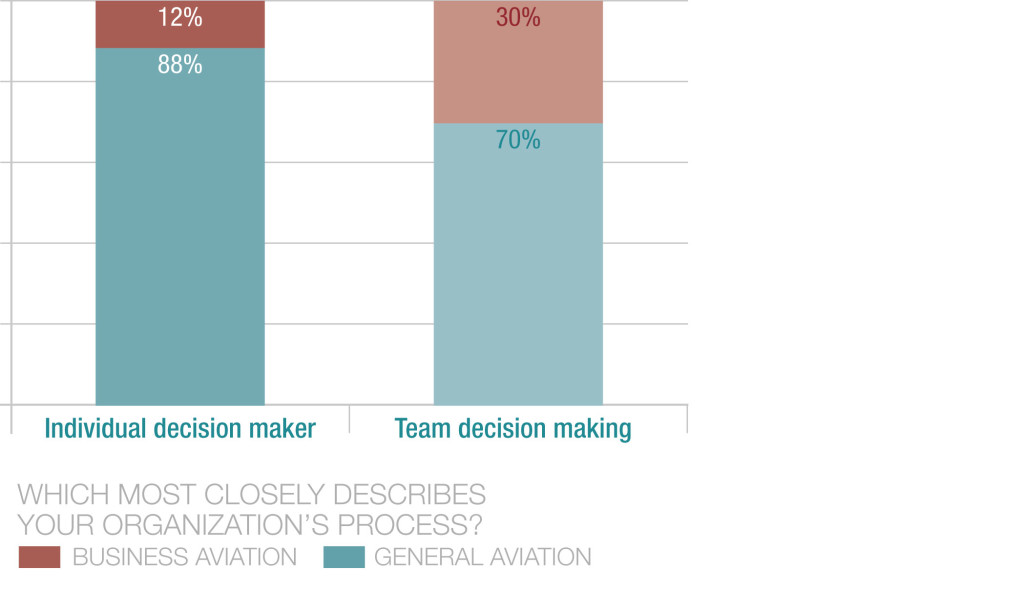

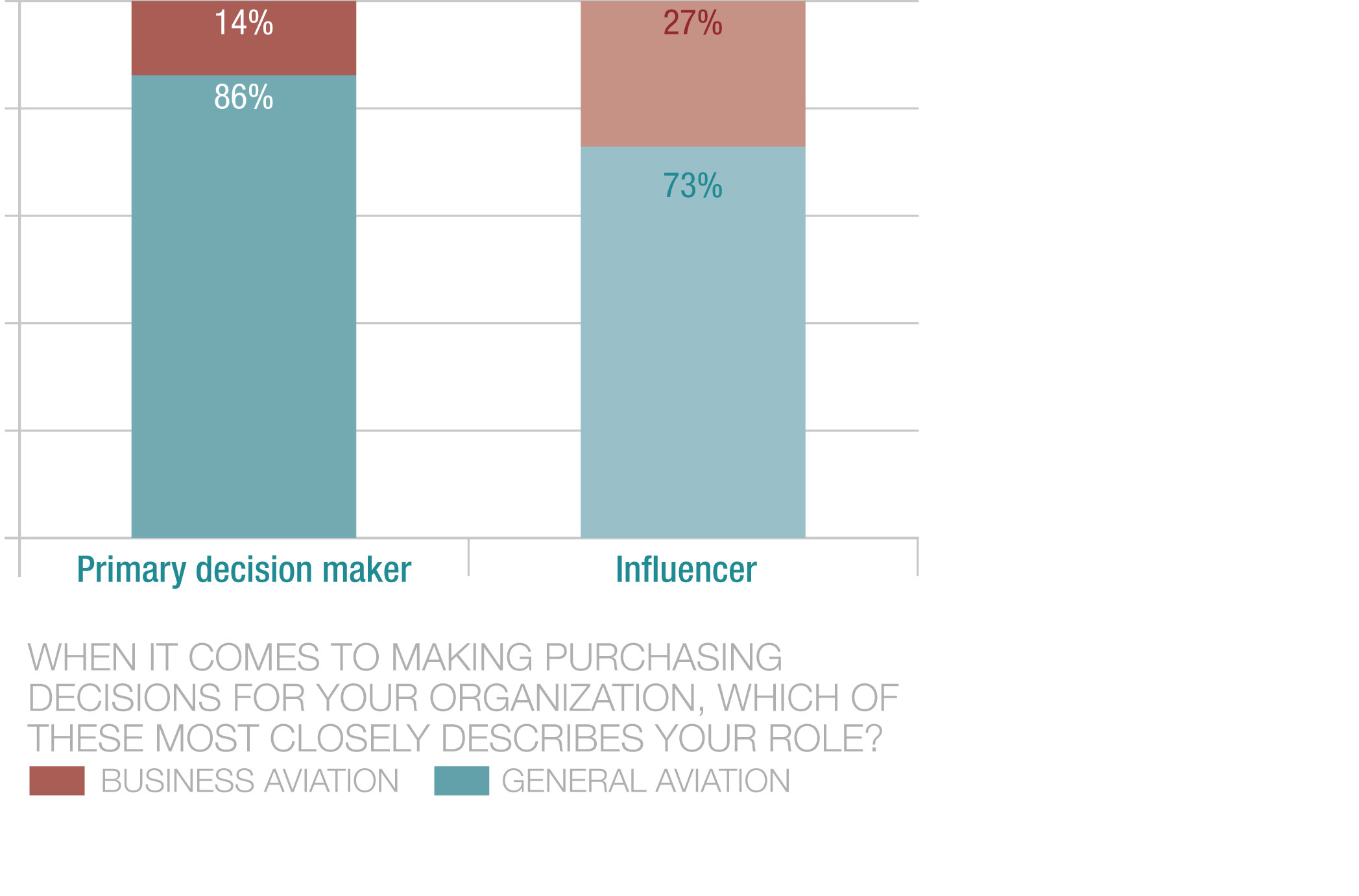

Older respondents in GA are much more likely to be part of an organization with an individual decision maker and to describe themselves as a primary decision maker.

While there is much more team decision making within the BA segment, about half of these respondents say they make the final decisions. Further analysis showed that younger respondents are more likely to describe themselves as influencers in an organization where team decision-making is the norm.

Based on all of these findings, marketers looking for quicker sales in either segment may want to focus on older prospects who are generally better off financially and are also in a position to make individual decisions without team or committee consultation.

Younger respondents (those under 50) tend to have a larger presence in functions such as manufacturing, marketing and with dealers. Fifty-somethings are strong in engineering, marketing and with dealers. And the oldest respondents dominate senior leadership, finance, purchasing and procurement and aircraft ownership.

Not surprisingly, aircraft owners and operators dominate GA while there are a significant number of self-described senior leaders in BA. Once again, the older prospects are likely to be the most attractive targets for marketers, depending on what is being sold.

Survey findings are most reflective of respondents with a focus on fixed wing businesses in the GA and BA segments, but rotary wing and commercial aviation were relatively well represented. If you market to these groups, this information should prove valuable.

Coming up next week: See what respondents value most in products, in services, and in suppliers (hint: it’s not brand or reputation) and see how priorities change based on age and market segment.

To further improve and approach your marketing in a more strategic fashion, download this easy-to-use marketing planner. It’s one of the most popular resources we offer.

7 Research Questions that Can Change Your Marketing Forever

BDN believes in research both for the industry and for our clients. And you should, too.

Please don’t discount research because you think you understand your audience. No one in our field can afford to base marketing decisions and investments on guesswork or assumptions about audience definition, needs and preferences. You have to know.

This Forbes article, “Why Knowing Your Audience is the Key to Success,” advises that “a solid market research campaign plays an important role in a successful marketing initiative by giving you the information you need to focus in on your audience and content.” And that’s really the point — gathering the right information to make your marketing more effective.

However, research is a complex topic that should not be approached lightly. If you’re thinking about conducting research of your own, it’s important to ask the right questions. Whether you are doing one-on-one interviews, focus groups, or an online written survey, here are 7 types of questions you’ll want to include in your research initiative.

- Who, specifically, are the decision makers for purchasing your products/services? Procurement people? Pilots? Maintenance personnel? Others? Prioritize them, separating by market segment if needed.

- What role do they play in purchasing decisions? Are they influencers? Sole decision-makers? Part of a committee or team?

- How do your targets make decisions? What factors are most important to them? Do they value price above all else? Strive to understand everything you can about their decision-making process and tailor your marketing to match.

- What are the demographics of your audience? Consider asking about gender, age, and geographic location, for example. Cross-tabulating this information with other findings can provide valuable insight.

- What does the audience know or believe about your company and products versus competitive offerings? Are they aware of your business and product line? Do they have a positive impression? Understanding awareness and perceptions will fundamentally shape your campaign strategy and tactics.

- What are the pain points, problems and challenges they face? For example, if they are challenged by unreliable products — and if reliability drives their decision-making — you have gained a valuable leverage point that can set you apart from the competition. Also, consider including an option for respondents to write in comments. These can be incredibly helpful.

- Where and how do they learn about products and services that may be of interest to them? From Google to advertising, print collateral to dealers, learning what channels are most influential can guide how and where you invest limited marketing budgets.

Want to learn more? Don’t miss this in-depth piece from B2B International.

And watch this space next week, when we begin presenting original research detailing how purchasing decisions are made within the general and business aviation markets.

Aerospace Advertising: What We Learned

When it comes to advertising, there’s one thing we can all agree on — things are changing.

Our month-long look at advertising was filtered through the lens of aerospace marketing professionals who shared their thoughts, experiences and insightful comments.

There were no true eureka moments — some findings were predictable and many a bit surprising — but we did learn a lot and uncovered several valuable takeaways.

While the survey shows that print is still important, the comments add some revealing caveats. Some marketers support print but characterize it as somewhat of a “necessary evil,” acknowledging that it is “unaccountable, expensive and slow,” yet driven by the belief that it is still necessary to reach older decision-makers.

Digital is valued because it is “trackable, targeted, and interactive,” and we are encouraged that marketers value measurement. Respondents are increasing their digital spending and most agree that digital advertising will ultimately displace print. The only real question is when it will happen. The cost difference between print and digital was mentioned quite frequently — BDN predicts that gap will close. As digital demand increases, prices will, too.

The comments make it clear that for the time being, print and digital are both important. As one respondent said, “an integrated strategy involving digital and traditional communications works best,” and this is a position BDN generally agrees with.

With clear goals and a smart strategy, the correct mix of tactics is generally quite clear, and for us, this is the key takeaway. Start with a sound strategy and the tactics will take care of themselves. This complete marketing plan template — customized for aerospace and defense — can help.

To see complete survey results, click here. To view marketers’ preferred publications, click here. And to read respondent comments, click here.

Don’t forget — this listing of 300+ A&D-specific media is a useful tool for advertisers. Download yours here.

Advertisers Speak Their Minds

Part three of our April focus on advertising is a recap of written comments accompanying our survey about “The Role of Advertising in Aerospace & Defense.” The majority of respondents provided written comments. An array of 20 representative remarks, some edited for space and grammar, are included here. To see what your fellow advertisers had to say, read on.

Now, if you don’t want to miss a single comment (and believe us, you don’t), you can download an expanded written summary of what 75 marketing pros really think about A&D advertising.

Meanwhile, here is a recap of how industry marketing professionals responded to our request to “please share your comments about print and digital advertising as they relate to marketing programs for aviation, aerospace and defense.”

We hope you find it as interesting and enlightening as we did.

‘Print is Dead’

“Digital is the way to go. Print is dead. It is old news before it is even published and mailed. Websites that engage the customer base and apps that provide utility with advertisements are a gold mine for us.”

“Targeting options in digital advertising offer much more bang for the buck than traditional print advertising options. I received my new AC-U-KWICK today and promptly threw it in the trash.”

“Print media has become outdated and hard to justify. Digital media is more trackable, targeted and interactive.”

“As a small company trying to displace the big boys, we have our best success with sales letters and road trips. Our limited print ads have yielded zero sales. We strongly feel that traditional print ads (blue sky, aircraft, product shots) do not help a small company break through. But we also strongly feel that a non-traditional campaign combining multiple outlets could. We believe that non-traditional print ads will be more and more effective as our prospects replace their old school vanguards with younger staff. So, we are focusing hard on how to make a non-traditional approach work.”

“Flight International, Aviation Week and other high dollar placements are getting the axe in favor of a more diverse and digital-centric strategy.”

‘A Break from the Digital Onslaught’

“Print has sustainability and is ideal for increasing image and brand awareness.”

“The current generation of decision-makers still relies on print for in-depth reading and information. Digital is fine for transitory news, but not for critical study.”

“There is too much digital advertising through social media and emails, so I ignore it. But with print I take my time and read through the entire magazine looking for information that may help my business. It provides a break from the digital onslaught.”

“Digital advertising is still not as effective as print. There are still too many old school decision makers who are not technically savvy.”

“Print is still the way to communicate to C-suite execs.”

‘We Need Both’

“In today’s market, print and digital advertising must work hand-in-hand in the marketing mix. Online presence reinforces the branding efforts through traditional print media and gives a valuable sense of immediacy to the messages.”

“An integrated strategy involving digital and traditional communications works best. The publications still have influence, and working with them benefits our company.”

“While I still focus primarily on print advertising, I usually look for a digital add-on. This could be a digital copy of the magazine with hot links to advertising, or a banner ad that is included as part of my buy.”

“Print is still a necessary evil, but digital brings much more value.”

“When your marketing challenge is establishing brand awareness, print advertising tied to measurable digital landing pages is still a good investment. For the selling of an established product or service, there are more effective channels.”

‘Editorial Still Beats Advertising’

”The industry as a whole seems focused on placements to say they were in a magazine rather than executing a real strategy.”

“Editorial, whether print or digital, still beats all advertising. Print, when distributed at high-profile industry conferences or trade shows, is effective. Ads in daily or weekly newsletters are also effective. Digital ads and digital directories are my least favorite — there is so much noise on web pages that they go unnoticed, and most of the time they are annoying.”

“For our company, it seems that when new clients find us it always start with a Google search.”

“Advertising helps promote our brand, but direct mailers and other activities engaging customer prospects are most effective in generating/closing sales.”

“Print is unaccountable, expensive, slow and perfect for the bathroom or La-Z-Boy recliner. Digital means fast feedback, video demos, click-through tracking.”

Don’t forget — this listing of 300+ A&D-specific media is a useful tool for advertisers. Download yours here.

Read Additional Insights

For a PDF document with the complete, must-read comments, click the image and don’t forget, we welcome your feedback — so tell us what you think!

People’s Choice: A&D Marketers ID Preferred Publications

Because our industry is served by more than 300 aerospace and defense publications, a comprehensive survey determining individual preferences is simply not feasible.

Because our industry is served by more than 300 aerospace and defense publications, a comprehensive survey determining individual preferences is simply not feasible.

Instead, to identify and understand trends, we asked an open-ended question: “If you could only choose to advertise in a few industry publications (print or digital), what would they be?” By not requiring respondents to refer to a list of choices, we hoped to uncover trends in a more organic fashion.

Here’s what we learned, based on the number of write-in “votes” (shown below) for each publication, and congratulations to the top five: Aviation International News, Vertical, AOPA Pilot, Aviation Week & Space Technology, Flying, and Rotor & Wing.

So, what do you think of the list? Is it consistent with your experiences? Whatever your opinion, we’d love to hear from you in the comments section and facilitate a dialogue about the role of advertising in aviation, aerospace and defense marketing.

Next Up:

Our series on the “The Role of Advertising in Aerospace and Defense Marketing,” will continue next week as we share verbatim comments from more than 100 industry marketing professionals who took our survey. Watch for it on April 19.

Don’t Forget:

A more substantial overview of survey findings is available here. Also, if you find our blog and other resources to be useful, please share them with a friend!