Purchasing Behavior in GA & BA Part One: Demographics

Working in conjunction with AVweb, BDN Aerospace Marketing recently surveyed 2,500+ general and business aviation professionals to better understand who they are, and how and why they make purchasing decisions.

Respondents ranged from self-described line pilots and private pilots to directors of maintenance and CEOs. All are involved in aviation, working in businesses ranging from real estate and security to agriculture, mining, software, architecture, construction and much more. It’s a diverse and interesting group that largely self identifies as purchasing decision makers. If you market to these individuals, this high-level overview should be helpful, and more details are available on request.

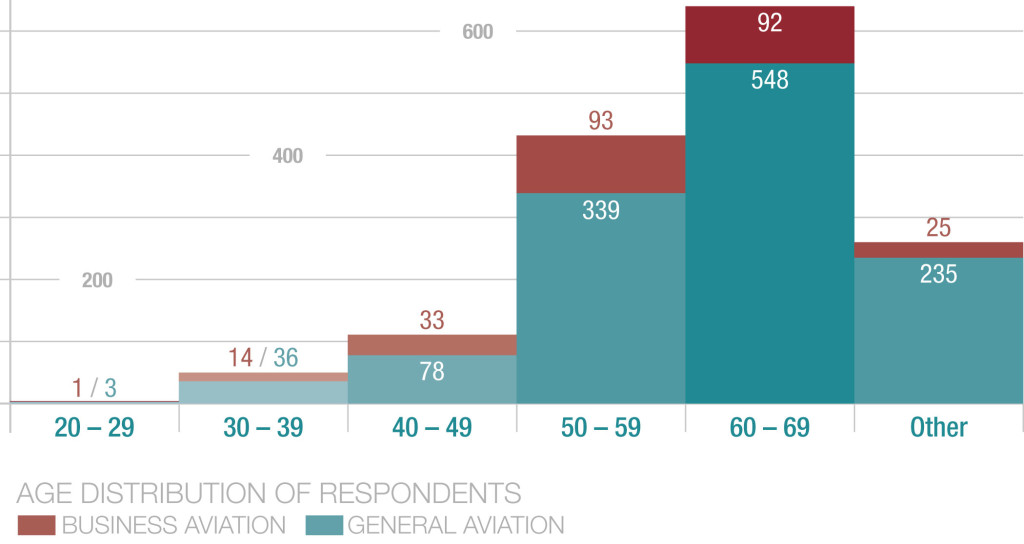

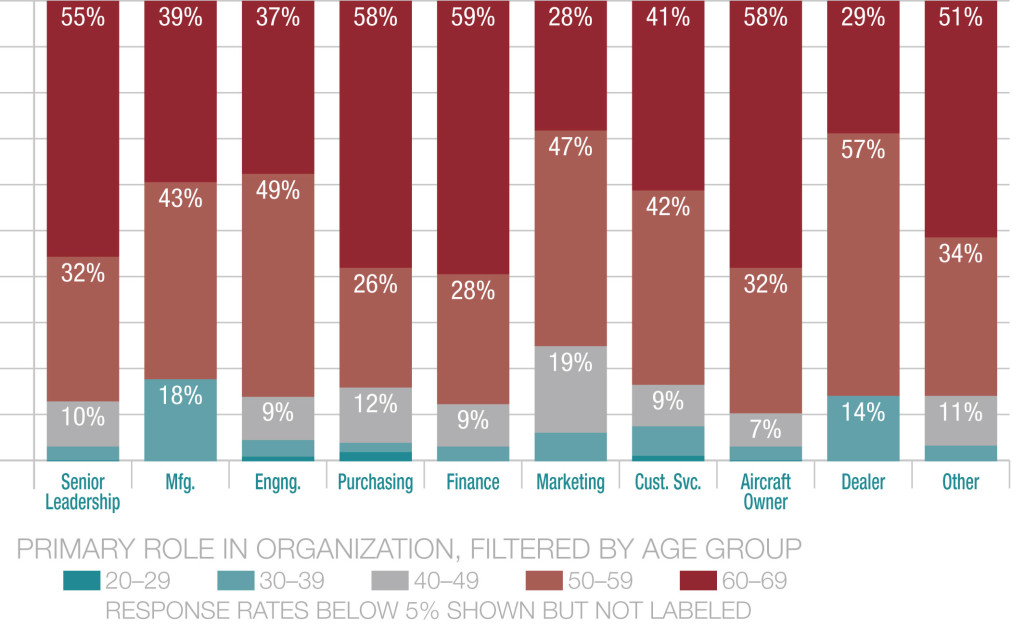

Today our focus is defining and understanding this group of respondents, and we will start by saying this: they are old. In fact, older than we expected, and as marketers, we must be keenly aware of this finding.

We already know that the GA and BA communities are aging. The Aircraft Owners and Operators Association (AOPA) reports that between 1990 and 2010, the average age of U.S. pilots, for example, increased from 40.5 to 44.2, and that number continues to rise, “posing serious challenges for the industry.” Our respondents, who represent more than just pilots, were older still. Those in business aviation are notably younger than those in general aviation, but still aging. Less than 20 percent of the BA respondents are under 50 and that number drops to less than 10 percent for GA.

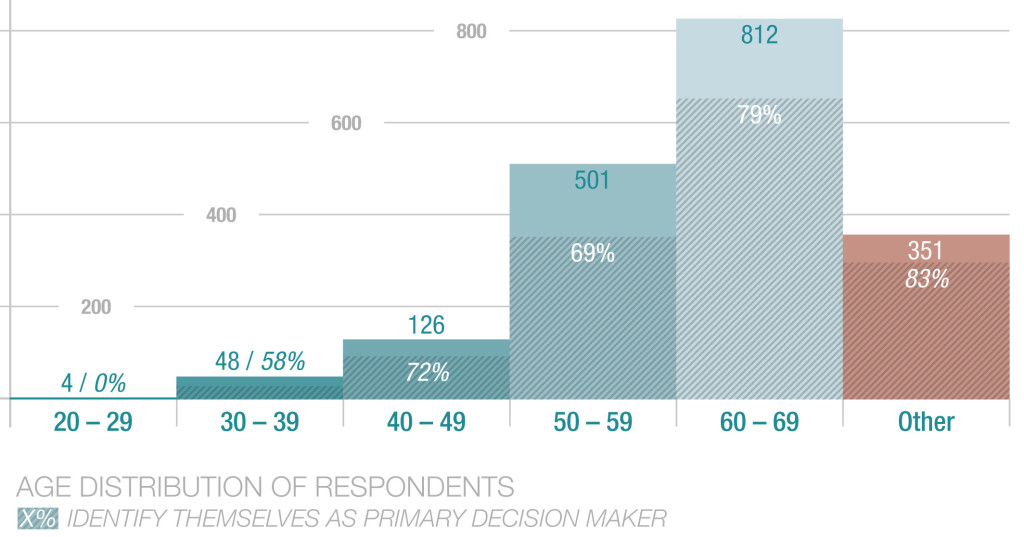

In the group surveyed, the vast majority of respondents were 50 or older, but that doesn’t mean we can ignore the under-50s. These younger people do play a role as influencers and decision-makers, and we need to understand and market to them now, preparing for the time when they represent the majority.

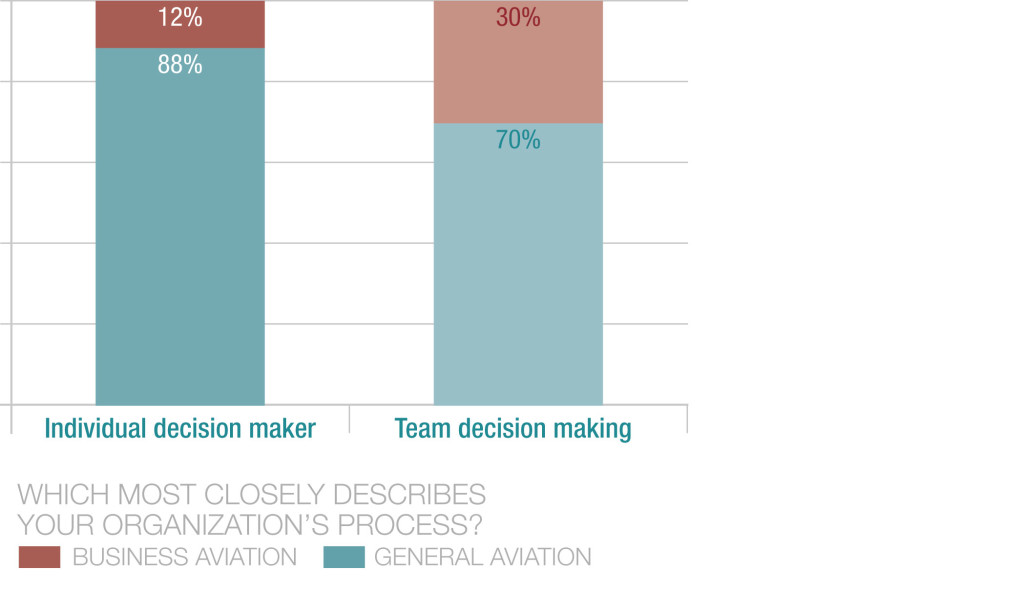

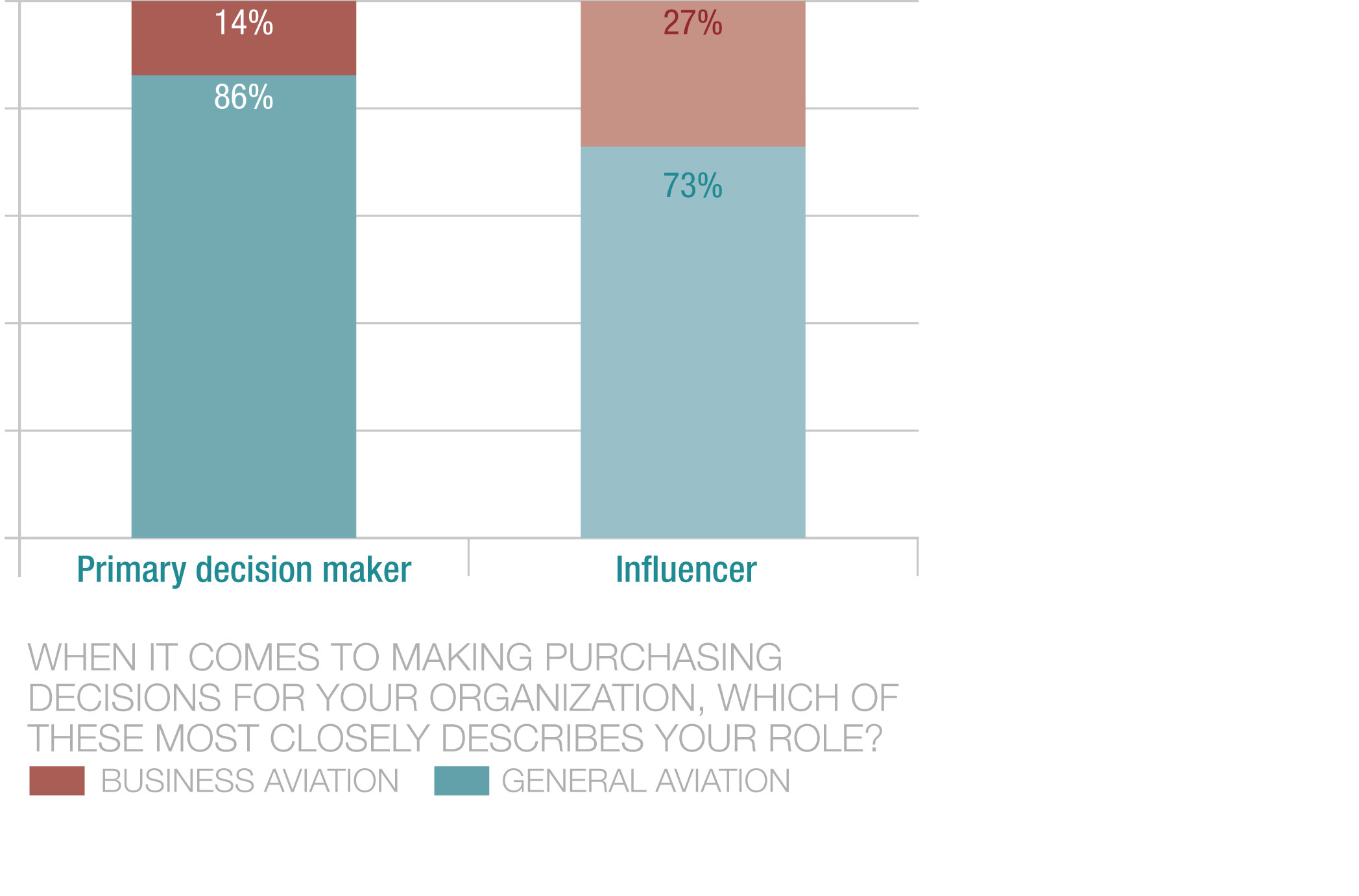

Older respondents in GA are much more likely to be part of an organization with an individual decision maker and to describe themselves as a primary decision maker.

While there is much more team decision making within the BA segment, about half of these respondents say they make the final decisions. Further analysis showed that younger respondents are more likely to describe themselves as influencers in an organization where team decision-making is the norm.

Based on all of these findings, marketers looking for quicker sales in either segment may want to focus on older prospects who are generally better off financially and are also in a position to make individual decisions without team or committee consultation.

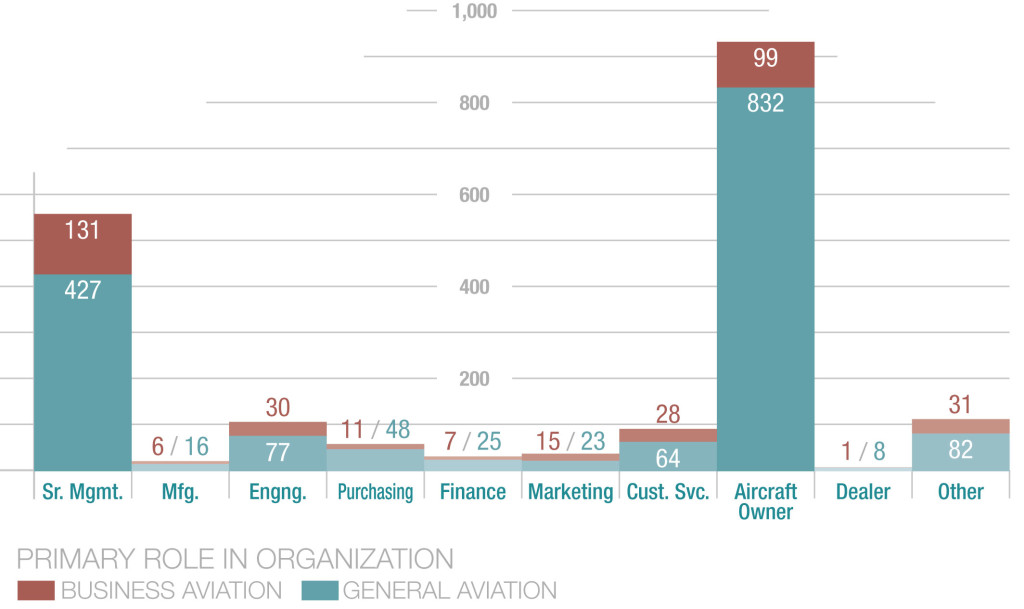

Younger respondents (those under 50) tend to have a larger presence in functions such as manufacturing, marketing and with dealers. Fifty-somethings are strong in engineering, marketing and with dealers. And the oldest respondents dominate senior leadership, finance, purchasing and procurement and aircraft ownership.

Not surprisingly, aircraft owners and operators dominate GA while there are a significant number of self-described senior leaders in BA. Once again, the older prospects are likely to be the most attractive targets for marketers, depending on what is being sold.

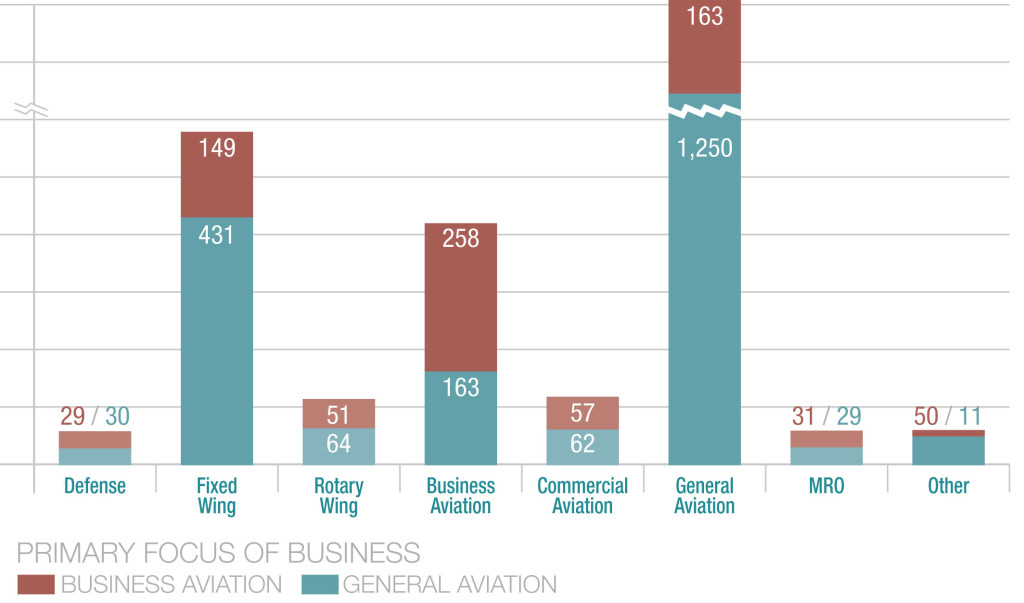

Survey findings are most reflective of respondents with a focus on fixed wing businesses in the GA and BA segments, but rotary wing and commercial aviation were relatively well represented. If you market to these groups, this information should prove valuable.

Coming up next week: See what respondents value most in products, in services, and in suppliers (hint: it’s not brand or reputation) and see how priorities change based on age and market segment.

To further improve and approach your marketing in a more strategic fashion, download this easy-to-use marketing planner. It’s one of the most popular resources we offer.