Category: Branding

Blueprint for Branding

BDN fields a lot of questions about branding, and that’s what inspired this month’s series. If you’ve already determined that you have a branding problem, this blog is for you. Here we outline a process for branding and walk you through what’s required to create or revamp your aerospace business brand strategy.

- Identify and Understand

You’ll need to conduct research in three key focus areas to gather the insights, data and intelligence that will inform your brand strategy.

Focus: Industry and Markets

- Identify relevant trends and opportunities in the industry – it will help ensure that your branding choices are in line with market realities

- Scope your market by size and segments

Tip: To keep your branding project on track, make sure you understand both company goals and sales goals, and how the brand will support them.

Focus: Customers

- Identify existing and potential targets

- Assess levels of awareness of you and your competition

- Understand perceptions of you and your competition

- Find out what customers need and value

- Uncover their pain points

Tip: Ask questions about the decision-making and buying process. Where do your customers get information? How do they research products? What factors most influence their buying decisions?

Focus: Competition

- Identify key competitors

- Determine relative market share

- Define their products and services as they relate to yours

- Assess their brand identity and messaging

Tip: Does everyone’s messaging sound the same? Do visual identities seem similar? This is a great opportunity to look and sound different.

Once all information has been gathered, analyze and synthesize what you have learned and refer to it in making these upcoming critical brand decisions.

- Develop Brand Strategy

Your brand strategy helps establish your company’s best possible position in the market. Think of it as your aerospace and defense sweet spot.

Focus: Positioning

- Above all else, what one thing do you want to be known for?

Tip: Resist the temptation to try and be everything to everyone. It dilutes the brand you are working so hard to create.

Focus: Differentiation

- What one thing really makes you different? How do you add and deliver value to your customers?

Tip: This needs to be more than lip service about “quality” or “passion.” Everyone has those messages. This statement needs to capture the essence of what make you different than every other provider.

Now you begin the process of creatively translating everything you’ve learned so far. All-too-often this is where branding initiatives begin and end. But shortchanging initial steps in the process will leave you with a brand that lacks substance and meaning.

- Define the Brand

Making sure that your definition aligns with your prospects’ needs, preferences and pain points, detail how you want to be perceived and how you want people to feel, think and talk about you.

Focus: Architecture

- Are you a house of brands? A branded house? Or something else? What are the elements of your brand and how do they all work together?

Tip: Keep your structure simple and memorable. Too many companies create brand confusion by naming and designing logos for everything under the sun.

Focus: Personality

- What is your voice and overall sensibility? Is it highly technical? Or is it something more human? Lofty and formal? Or down to earth and approachable?

Tip: You can’t fake this. Whatever you decide to be; be authentic.

Focus: Messaging

- This encompasses your story, value proposition, key supporting messages and a tagline, if appropriate.

Tip: Make it fresh and memorable. Don’t settle for something that is boring and predictable or full of buzzwords. Need help? Download BDN’s Guide to Crushing Your Competition with the Perfect Value Proposition.

Focus: Visual Identity

- From your logo and color palette to your fonts and photos, what does your brand look like?

Tip: Start with a mood board and get incremental buy-in from a few key stakeholders. Always move the discussion away from subjective opinions, have a solid rationale to back your recommendations and stay focused on the real audience.

Focus: Culture

This is all about your company’s core values and how you live and breathe the brand internally.

- How will the brand manifest within your company? What are expectations for employee performance and behavior?

Tip: It’s essential that the CEO believes in, embodies and champions the brand. Your branding project cannot succeed without this executive-level buy-in.

Thanks for reading! If you liked this blog, these other resources about B2B branding may also be of interest.

Bop Design developed a Quick Reference Guide for B2B Branding that includes helpful definitions, dos and don’ts, and more.

This Strategic Marketing Roadmap for small- to medium-size businesses emphasizes the branding process. Shout out to Marketing Mo for this in-depth resource.

Looking for expert assistance? Download BDN’s Guide to Selecting a Professional Marketing Firm.

Realize the Full Value of Your Aerospace Business Brand

Taking on a branding or rebranding program for your aerospace business is not for the faint of heart. Brand work requires discipline, focus, commitment and, above all, honesty.

In our last edition of the Flight Manual we listed 10 warning signs that you might have a weak brand. This week, courtesy of Lippincott, we are providing a list of questions to jump start the branding discussion internally.

If you think you have a branding problem and want to take steps to address it internally, we suggest starting with a very small team of strategically minded leaders who are willing to take an unflinching look at your business and answer these questions. There is no room for ego or living in the past, and this is not a job for a large committee.

This more detailed assessment will not be easy, but it is a necessary step in further assessing the health of your brand and getting internal alignment on how or if to proceed, which is critical.

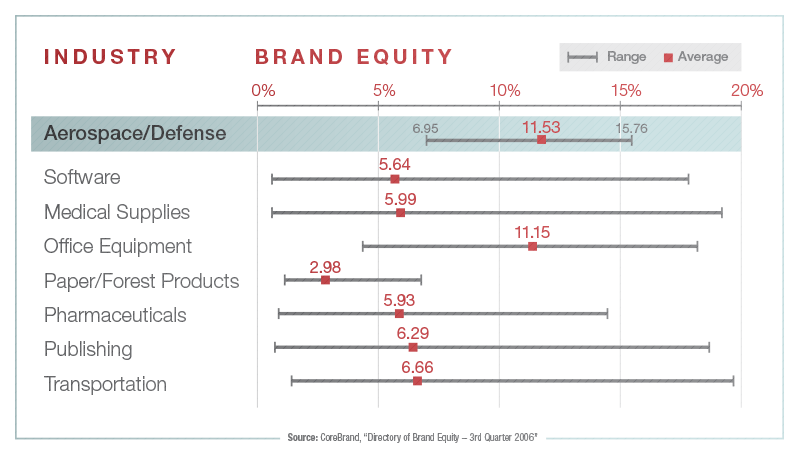

Are you faced with skeptics who argue that branding is not important to aerospace and defense businesses? This data from the Harvard Business Review speaks for itself.

Bear in mind that these questions are just a starting point. Audience research is advisable to validate your internal assumptions and get a true picture of how you are perceived.

- Does our reputation immediately put us on our customers’ mental short lists for their next big orders or programs? How do we know one way or another? If we don’t know, how do we plan to find out?

- Are we on our customers’ preferred supplier lists? If so, where do we place, and how does that compare to our place last year or two years ago? If we’re not on the list, why is that and what do we expect to do about it?

- Does our brand help us to hire world-class talent? What does our brand stand for with potential recruits? Do we even know? For that matter, what do our employees think about our brand — or about any of our product brands? Are they proud of the name—or ashamed of it? Do they encourage or discourage others to join the company?

- Could our brand help us win a bid if reputation were the deciding factor? If not, why not? Why might our competitor’s brand help them win instead?

- What does our brand say about us to potential new customers? Does our brand give us entrée to expand into adjacent markets? To take on higher value-added roles such as consulting services? Or are we forever painted as one particular kind of company, unable to do anything different?

- To what extent is our brand being eclipsed as our big customers or channel partners consolidate and become better-known to end customers and Wall Street?

- What do we need to do to keep our brand from disappearing?

- Do investors really know us? How does Wall Street describe us? How does that square with how we see ourselves?

- Do we have the right mix of brands to go to market? Do our brands fit together logically? Are we supporting and spending on the right brands?

- How smart are we about our own brand? What should our brand stand for? Can we describe our brand strategy in a 20-second elevator pitch? What’s different about it? What does it contribute to the bottom line? Which customer touchpoints make the biggest difference to our brand?

- Are we actually living the brand? Do our employees know how to deliver our brand? Do they have the tools to do so?

Source: Lippincott originally published these 10 “Call to Action” questions in an excellent resource called “The Rise and Rise of the B2B Brand.”

Up Next

Moving Ahead: Your Blueprint for Branding

Also

If you liked this blog you may also want to read about the “5 Branding Myths that are Hurting Your Aerospace Business.”

Does Your Aerospace Business Have a Branding Problem?

We hear from lots of aerospace and defense professionals who think they have a branding problem or who tell us they want to “take their brand to the next level.”

We hear from lots of aerospace and defense professionals who think they have a branding problem or who tell us they want to “take their brand to the next level.”

Quite often they are thinking about their brand in visual terms, and it’s true that design is a critical element of any great brand. But there’s so much more to consider when evaluating the strength of your brand.

Now, as we continue our month-long series about aerospace industry branding, it’s time to take stock.

Before we launch into detailed recommendations about repairing or rebuilding your brand, let’s consider if you do in fact have a brand problem.

Start by taking this quick 10-question assessment as a first step in the process. Each “yes” answer is a red flag; and multiple yeses are a strong indication that your brand is in trouble and further action is required.

10 Red Flags

Weak brands share many or all of these characteristics.

- Do you consistently compete on price?

- Does your business lack a clear focus and do you try to be everything to everyone?

- Are you unable to articulate a true value proposition — something customers care about that distinguishes you from everyone else?

- Does your brand architecture create confusion? Confusing brands have too many individual product names or sub-brands, and multiple logos, taglines and messages.

- Does your CEO fail to actively support or champion branding?

- No single person owns the brand internally, standards don’t exist or are not followed.

- Is your market, your business or your business strategy undergoing significant change?

- Does your company suffer from the “me too” syndrome, where nothing looks or sounds unique? And does your leadership wants you to fit in and fall in line with what others are doing and saying?

- Are you in a crowded market space and not growing?

- Is your messaging company-centric and not customer-centric?

If you’d like to dig deeper and start seriously assessing your brand, this Lippincott resource is a great place to start.

Want to see a ranking of the 25 most valuable brands in aerospace? A few of them just might surprise you.

Up Next: Find out how to build or rebuild your aerospace industry brand. We’ll walk you through the process one step at a time.

5 Branding Myths that are Hurting Your Aerospace Business

Branding is an ongoing source of discussion and disagreement in aerospace marketing, according to our recent industry surveys.

While some say they spend a lot of time and effort building their brand, far too many say that investing in branding is a waste of time and money.

As we enter into a month-long examination of aerospace industry branding, we start by tackling these 5 myths that are holding us back from better branding, better marketing and better results.

Myth No. 1: Branding is a waste of money.

Really? Consider this.

Valued at $121.8 billion, Microsoft’s B2B brand is the most valuable in the world. Siemens, a company with strong interests in aerospace, ranks at No. 20 with a value of $12.4 billion. Read more here.

But there’s more. A McKinsey study of B2B brands shows that companies with brands that are perceived as strong generate a higher EBIT margin than others.

In fact, strong brands outperform weak brands by 20 percent. A Forbes article, “Why B-To-B Branding Matters More than You Think,” cited the example of pump manufacturer Gardner Denver, reporting that the company attributes 43 percent of its value to be goodwill and other intangible assets.

This is consistent with our experience and our research. In one engagement, our client research showed that although two direct competitors had virtually identical ratings for factors like product quality and reliability, respondents were twice as likely to buy from the one with a large, well established brand name. When all other factors were equal, the best brand won.

Myth No. 2: Branding is only for consumer companies and has no bearing on a customer’s decision-making process. People will buy from us if we provide good products and competitive prices.

We hear this a lot. But the Forbes article reports that B2B brands are actually more important than B2C brands because B2B purchases matter more. “Buy the wrong toothpaste, and you can always change brands when the tube runs out. Buy the wrong turbine and you could hurt your company’s earnings for years – and find yourself looking for another job.”

Trust is paramount in our industry, and is a critical factor in any B2B buying decision. But you can’t sell trust by telling people you are trustworthy in an ad or a brochure. They have to feel it — and that happens through a clear and consistent brand experience.

Myth No. 3: My brand is my logo and tagline.

Your logo (and tagline if you have one) is an incredibly important part of your brand, but it’s only one element. Logos serve as a kind of visual shorthand for your business to help customers immediately identify and recall who you are and what you do.

Branding is also not synonymous with marketing. Marketing certainly contributes to a brand, but like the logo example, it is one small part of a much larger whole.

Writing for the Tronvig Group, James Heaton defines branding as “the expression of the essential truth or value of an organization, product, or service. It is communication of characteristics, values, and attributes that clarify what this particular brand is and is not.”

Heaton nails it, especially when he says this. “A brand will help encourage someone to buy a product, and it directly supports whatever sales or marketing activities are in play, but the brand does not explicitly say, “buy me.” Instead, it says, “This is what I am. This is why I exist. If you agree, if you like me, you can buy me, support me, and recommend me to your friends.”

As we tell our clients, a solid brand and strategic marketing program won’t make the sale, but they will create an environment conducive to making the sale.

Myth No. 4: Branding is for big companies with big budgets.

Once upon a time this may have been true. Building an aerospace brand has traditionally relied largely, but not exclusively, on advertising.

But advertising is expensive and it can be challenging to show a return on the investment made. For those who aren’t in a position to advertise, social media is a great and affordable tool for defining and building your brand, all while interacting with your audience and giving them a feel for who you are.

At a time when many aerospace businesses look and sound alike, small companies, especially, can leverage branding to set themselves apart from competitors, get noticed and be remembered!

For more ideas and inspiration, see how several B2B businesses, including GE and Maersk Line, are successfully using social media to build their brands.

Myth No. 5: Brands appeal to emotional buyers. B2B buyers make rational decisions.

B2B buyers are people. And people have emotions. Marketo makes the case that because B2B buyers are overwhelmed by information they use heuristics (a simple and efficient emotional shorthand used in decision-making). In fact, “whether or not the buyer realizes it, the decision is often made long before the buying process is completed. When this happens, even subconsciously, much of the buying process ends up being an effort to justify the initial emotional decision. B2B marketers can and should tap into this by appealing to the emotional side of their prospects, as well as their rational side. This is where branding comes in.”

Does your business believe in branding? Do they invest in it? Why or why not?

If you like this article, you may also be interested in:

7 Discouraging, Surprising, Yet Hopeful Truths About Modern Aerospace Marketing

BDN routinely uses research to understand, benchmark and report the trends and realities impacting the work we do as aerospace marketers.

In our most recent survey we asked aerospace marketers questions about their approach to budgeting and planning, goal-setting, goal accomplishment, their most effective tools and techniques, and levels of satisfaction with their company’s marketing performance.

We wondered, “Is there a correlation between those who plan and those who get results?” “Are some tactics consistently much more effective than others?” And, “Do budgets equate to higher perceived performance?”

It turns out that the answer is yes to all these questions, yet there is still much to be learned. Today we are providing a high-level summary of our findings with key takeaways and insights that shine a light (not always a flattering one) on our industry and our profession. This is ideal for those who want a quick read.

Anyone who would like more in-depth charts and findings may request the complete survey results here.

And remember, these results are suggestive, not scientific.

Key Insights & Takeaways

Finding: Regardless of their annual revenue, aerospace companies are still under-spending on marketing, with many high-revenue businesses spending just as little as their lower-revenue counterparts.

Insight: Shame on us. It’s hard to believe, but 20% of the $100,000,000 businesses have marketing budgets under $100,000. That’s an embarrassingly small .001%, and far below recommended spending and benchmarks for both B2B and our industry.

Takeaway: The budgeting process in larger companies sometimes defies logic, with decision-makers removed from the realities of individual functions. Verbatim comments tell us that more than a few companies are actually cutting marketing because industry conditions are bad. Huh? Marketers who work for an organization like this can either use data and measurement to become agents of change from within, remain ineffective, or run.

Finding: Most marketing budgets have stayed the same since 2015; a good number have increased; and very few have been cut.

Insight: Yes, this is positive news, but remember, budgets are still below accepted standards. Harvard Business Review generally suggests investing 3% of revenue in marketing, with adjustments made for specific scenarios.

Takeaway: Management probably believes marketing has everything it needs to be successful. After all, they have added or maintained existing budgets. But we can and must do better. If you are working with a limited budget, stop defaulting to old school tactics that can’t be measured — and when management wants you to do the same old, same old, explain that you can’t afford anything that fails to deliver ROI. Position yourself as the expert and start showing results to upper management that will justify the higher budget you know you need.

Finding: The majority of respondents say they do have and follow a marketing strategy and plan, yet there are striking differences here based on company revenue. More than 90% of the largest companies have a plan; less than 50% of the smallest do.

Insight: The survey shows that those with a strategy and plan are more satisfied with their company’s marketing performance than those without. It also shows that, as spending levels rise, so do levels of satisfaction with overall marketing performance.

Takeaway: A strategy, plan, adequate budget and measurement are the keys to your marketing success, regardless of company size. But if you are working with a smaller budget, strategy and planning become even more critical to ensure that every dollar spent is associated with an expected, measurable outcome.

Finding: Most respondents reported success in accomplishing key objectives. Improved brand awareness, improved customer engagement/relationships and increased sales were most frequently cited. Interestingly, 12% of those spending less than $100,000 report that they accomplished none of their objectives last year – no one spending $1 million or more said they accomplished nothing.

Insight: Regardless of budget, brand awareness and leads were cited as top successes. Because brand awareness is more difficult to measure it may be a more comfortable “metric” for some marketers. Challenge yourself to achieve more measurable objectives moving forward.

Takeaway: People are reporting success, and that’s good. Let’s just make sure those claims of success are based on data you can defend.

Finding: The most effective digital marketing efforts were websites (83%) and email marketing (79%). The highest marks for ineffective tactics were social media, blogs and online display ads, yet plenty of marketers also found them effective.

Insight: One, people are divided about what works in the digital realm. Also, while websites are recognized as effective, less than 50% say their SEO is effective.

Takeaway: We think the sheer volume of new and changing tools and options overwhelms many marketers. The first step to using the right digital tactics is understanding them – make time to get smart and use data to determine what is and is not working.

Finding: The most effective traditional marketing efforts were events and print advertising, yet print advertising also was most frequently called out as ineffective.

Insight: We continue to rely on old school tactics, perhaps to appease older, old school management, that are less likely to be measured.

Takeaway: If you are using events and print advertising (often the most expensive tactics) make sure you are tracking results. There are tools and techniques that make it possible to know if these approaches are working.

Finding: In 2016, marketers overwhelmingly say their No. 1 objective is increasing sales, followed by improved customer engagement, increased leads and improved brand awareness. Also, their No. 1 challenge is acquiring new customers, followed by lead generation and measuring ROI.

Insight: Hurray! Marketing exists to drive sales, and we are heartened to see folks acknowledging this connection.

Takeaway: Take a look at the relationship between marketing and sales in your organization. Are you using a CRM and marketing automation system to facilitate tracking, measurement and accountability? Are you working harmoniously toward a common goal? Or is there friction and finger pointing? Make mending and strengthening these relationships — adding in accountability for everyone — a priority for the good of the business.

Next up:

Keep reading next week for verbatim comments from more than 30 respondents who wrote to us about the challenges, opportunities and trends they are experiencing in their aerospace marketing work.

Don’t forget:

If you liked this blog post, you may also be interested in these free BDN resources:

- How to Develop a Marketing Communications Budget

- Budget Planning Checklist

- Marketing Planner

- 30 Days to Better Digital Marketing

7 Keys to Breakthrough Messaging for Aerospace and Defense Marketers

Memorable, iconic messaging looks effortless, but it’s anything but. Drafting the right three words (like “Here Comes Hope”) may take three minutes – or three hours – but is essential to effective marketing.

But how do you do it? Well, the truth is, most people aren’t wired to write goose bump-inducing copy. It can’t be done by committee, and it is less likely to come from someone within the company. I’m not sure it can be taught – but do know that understanding how to recognize it is important for all aerospace marketers.

7 Keys to Effective Messaging

- Tells a story, succinctly

- Makes you feel something

- Is audience-centric

- Feels authentic

- Does not require an explanation

- Transcends the expected and the ordinary

- Has something extra – a spark of creative genius – that elevates everything and makes the message sing. We call it the X factor. And you can’t have effective marketing without it.

The United States Armed Forces consistently delivers exceptionally strong marketing campaigns anchored by some of the best messaging in our space.

We’ve featured a few examples here, but you can easily find more with a couple of quick searches. They more than meet our criteria for inspired messaging. Do you agree?

You’ll find even more information about messaging in our Value Proposition Guide. It’s an in-depth resource that includes actionable insights, a checklist to evaluate your own value proposition, industry examples, and more. Or, take a look at our Portfolio, to see work examples and inspiration, all specific to aerospace and defense.

Critiquing An Aerospace Advertisement: AugustaWestland

Dear AgustaWestland,

Dear AgustaWestland,

Nothing about this ad makes sense to me, so I am assuming it was designed by a committee. Most likely it was a last-minute endeavor, and perhaps this was the only thing everyone could agree on, but your customers and employees deserve better. Your helicopters deserve better. And your brand deserves better. Heck, even the koala bear deserves better.

The most effective ads are simple, but layered with meaning. They don’t have to be literal. But they do need to artfully combine words and images to connect and communicate with readers, and they must tell a story that your audience cares about. Great ads are often deceptive in their simplicity, because they appear to have been created effortlessly. They trick you into believing anyone can do it. So you start out with a lofty vision and a great idea, then somehow end up with a bear, a helicopter and a cockpit.

Marrying the right idea with the proper imagery, inspired copy, and flawless execution isn’t easy.

I don’t mean to pick on the nice people at AgustaWestland — I have friends there. No one knocks it out of the park every time. But this particular ad, quite honestly, is more than I can bear.

Over to you, folks. Am I off base here?

Nostalgia Marketing. It Works.

There’s a new trend in marketing that has companies looking to the past to make an emotional connection with their customers. And according to a recent article in Adweek, it’s working for brands ranging from Jack Daniel’s to Lego. Connecting with the past, it seems, pays big dividends in the here and now.

There’s a new trend in marketing that has companies looking to the past to make an emotional connection with their customers. And according to a recent article in Adweek, it’s working for brands ranging from Jack Daniel’s to Lego. Connecting with the past, it seems, pays big dividends in the here and now.

Making an emotional connection with your audience isn’t easy, but it’s incredibly effective. Consider how an old song can make you feel. “Lights” by Journey will forever remind me of a summertime slow dance with my first crush. For better or worse, music takes us back to another place and time. I also have a soft spot for manual typewriters, Chevrolet Camaros, and Bit-O-Honey candy.

It’s human nature to view the past through rose-colored glasses, and this works to the marketer’s advantage. Your first car may have been dad’s beat up hand-me-down, but thinking about it now evokes happy memories of life as a carefree teenager.

This sentimental yearning for the happiness of a former place or time is powerful stuff, aerospace marketers. Imagine if you could tap into the emotional experiences your customers associate with their early flying days. What might making that connection mean to your brand?

Targeting your audience with pinpoint accuracy is critical to nostalgia marketing success. Clearly, the things that resonate with a 30-year-old pilot will be very different from what works for a 55-year-old. Skillful and authentic execution is equally important. If you inadvertently taint a cherished memory, your customers will make you regret ever taking a trip down memory lane.

This Adweek article has multiple case studies that are inspiring and informative. Good stuff: www.adweek.com/news/advertising-branding/seven-brands-are-winning-nostalgia-149174

How To Write A Stronger Value Proposition

I opened an excellent business aviation magazine this morning to an OEM ad touting the company’s “Fifty Years of Passion.” A few pages later I came across another full-page ad explaining, “Excellence Defines Our Company. Passion Makes It Fly.” Yawn. The ads are boring and probably ineffective because they lack a clear and compelling value proposition. Passion is not a value proposition. It’s great that anyone is passionate about their own products and services, but do any of us really care? I’m a lot more interested in specific outcomes and benefits. How will I benefit from using your product or service? Will it help me win new customers or improve profits? If so, I may want to know more, but only if you can grab my attention and show how you are really different and better.

I opened an excellent business aviation magazine this morning to an OEM ad touting the company’s “Fifty Years of Passion.” A few pages later I came across another full-page ad explaining, “Excellence Defines Our Company. Passion Makes It Fly.” Yawn. The ads are boring and probably ineffective because they lack a clear and compelling value proposition. Passion is not a value proposition. It’s great that anyone is passionate about their own products and services, but do any of us really care? I’m a lot more interested in specific outcomes and benefits. How will I benefit from using your product or service? Will it help me win new customers or improve profits? If so, I may want to know more, but only if you can grab my attention and show how you are really different and better.

How many times have you seen the same messages about Innovative Solutions or Commitment to Quality? It’s the ad copy equivalent of yadda, yadda, yadda. These one-size-fits-all statements lack specificity and credibility and fail to make the value proposition come alive. They are so generic they could apply to virtually anyone. Before you spend $10,000 or more to place an ad, consider these questions. Is it specific and credible in its claims or promises? Does it clearly appeal to the key factors that drive your customer’s decision making? Does it make a compelling case for why a customer should do business with you and not your competition? Will it capture the hearts and minds of your audience? If you can’t honestly answer yes to these four simple questions, your ad is not ready for prime time. Save your $10K, go back to the drawing board and make some marketing magic.

Airbus Rebrand: Will it Fly?

Rebranding is risky business and more than a few well-intended efforts have ended badly. The JC Penney rebrand was an epic fail that could drive the retailer into bankruptcy. A revamped Gap logo sparked a global uprising. And I’ve already blogged about American Airlines’ journey to become a “new American” by revamping its image.

Rebranding is risky business and more than a few well-intended efforts have ended badly. The JC Penney rebrand was an epic fail that could drive the retailer into bankruptcy. A revamped Gap logo sparked a global uprising. And I’ve already blogged about American Airlines’ journey to become a “new American” by revamping its image.

The most recent headline-grabbing change hits closer to home as EADS is renamed Airbus, and Eurocopter becomes Airbus Helicopters. The wisdom of this move is being hotly debated on news forums and online industry communities. At a high level, some folks acknowledge that Airbus is a successful brand with strong global equity. And we all know that the EADS name carried a lot of political baggage.

Drilling down, the military community seems to agree that nobody wants to take a bus to the fight.

And the helicopter people, well, they are mostly perplexed and pissed off. One blogger said killing the Eurocopter name is “ludicrous,” “silly” and a “PR disaster.” Another said it is “ridiculous to change the most successful global brand in helicopters.” I know from experience that any discussion of a name or logo change is an emotional minefield that turns rational people into raving lunatics. In this case, they may have a point. As one of my colleagues said, “if it ain’t broke, don’t fix it.”

In a well-intentioned effort to achieve unity and consistency in a rebranding, too many companies are inflexible and fail to account for the specific sensibilities and needs of niche markets. The Airbus shift may be a case of moving too far too fast. The prestige and power of the Eurocopter brand cannot be understated. The employees who have helped this company achieve industry prominence are personally invested in the brand, as are customers and helicopter enthusiasts worldwide.

Changing an iconic brand is like playing with fire. Let’s hope the fine folks at Eurocopter don’t get burned.